Onboard customers and collect info in a snap.

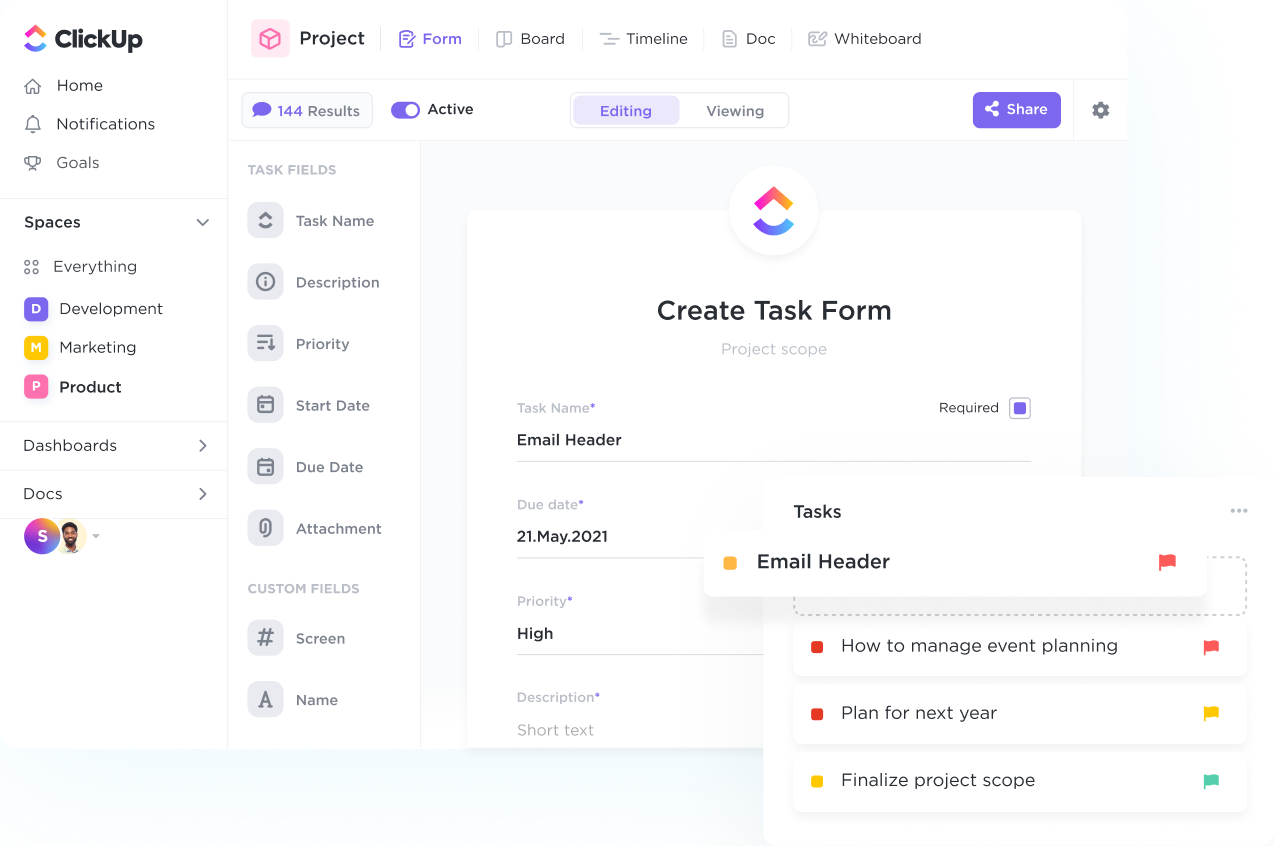

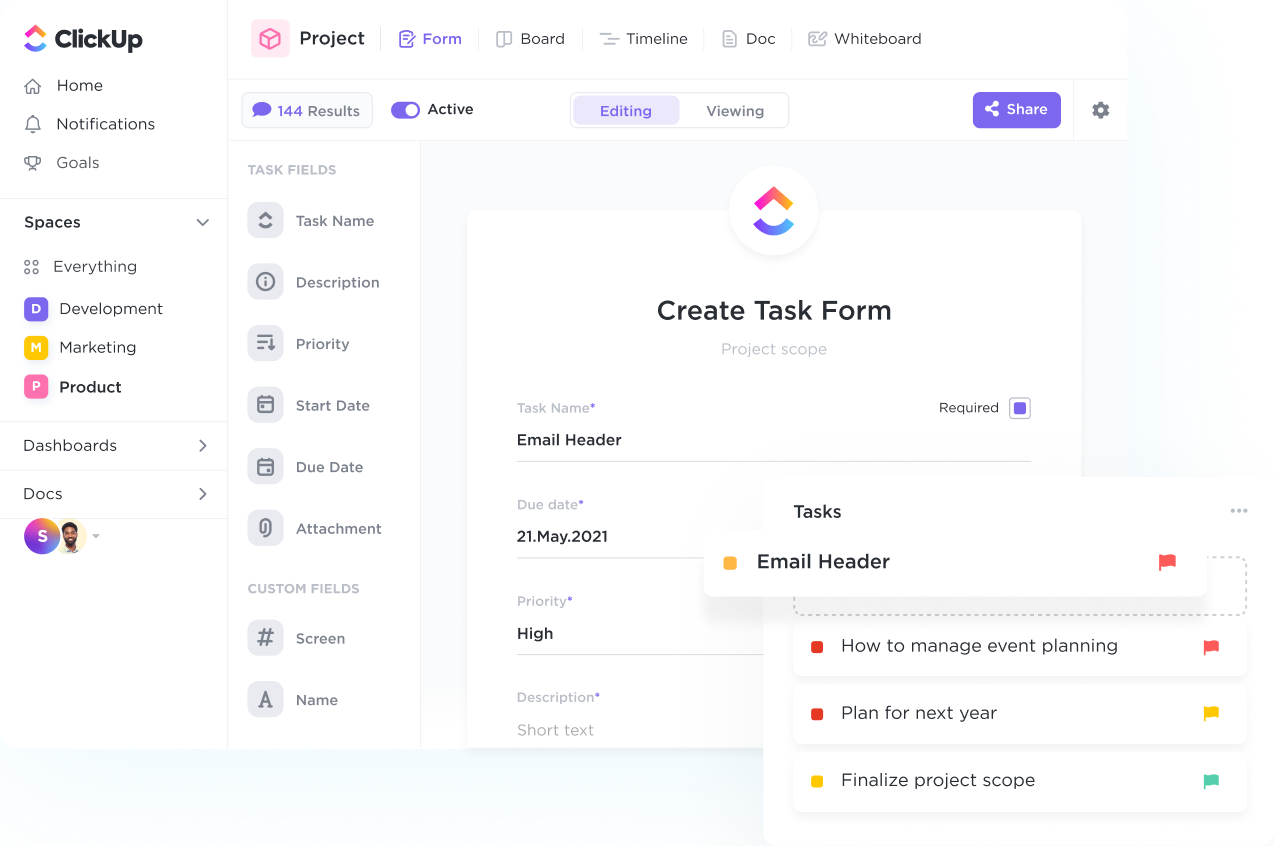

Streamline your intake process, organize response data, and automatically create tasks with custom branded Forms powered by conditional logic.

Supercharge your insurance agency with a customized CRM system powered by ClickUp. Streamline client relationships, automate tasks, and boost productivity like never before. Say goodbye to manual processes and hello to a seamless CRM experience designed specifically for insurance agents. Try ClickUp today and revolutionize how you manage your customers.

Free forever.

No credit card.

Trusted by the world’s leading businesses

Streamline your intake process, organize response data, and automatically create tasks with custom branded Forms powered by conditional logic.

Manage everything from sales pipelines, customer engagement, and orders with ClickUp's 10+ highly flexible views. Easily track and manage your accounts on a List, Kanban Board, Table view, and more.

Key features of CRM software that benefit insurance agents include customer database management, policy tracking, automated follow-ups, lead management, commission tracking, and reporting/analytics capabilities to track sales performance and customer interactions effectively.

CRM software helps insurance agents by organizing client and lead information in one place, enabling efficient tracking of interactions, follow-ups, and policy details. This streamlines lead management, improves client communication, and enhances overall productivity.

Yes, there are CRM software solutions specifically tailored for the insurance industry. These systems offer industry-specific features such as policy and claims management, lead tracking for insurance agents, integration with insurance underwriting systems, and compliance tools. They are designed to address the unique needs of insurance companies, improving efficiency, accuracy, and customer service in the insurance sector.