Build the perfect customer database.

Create your ideal system to store and analyze contacts, customers, and deals. Add links between tasks, documents, and more to easily track all your related work.

Transform the way Hedge Fund Managers optimize client relationships with ClickUp's tailored CRM system. Streamline communication, track interactions, and manage data effortlessly to enhance client satisfaction and drive business growth. Revolutionize your approach to customer relationship management and elevate your hedge fund management with ClickUp.

Free forever.

No credit card.

Trusted by the world’s leading businesses

Create your ideal system to store and analyze contacts, customers, and deals. Add links between tasks, documents, and more to easily track all your related work.

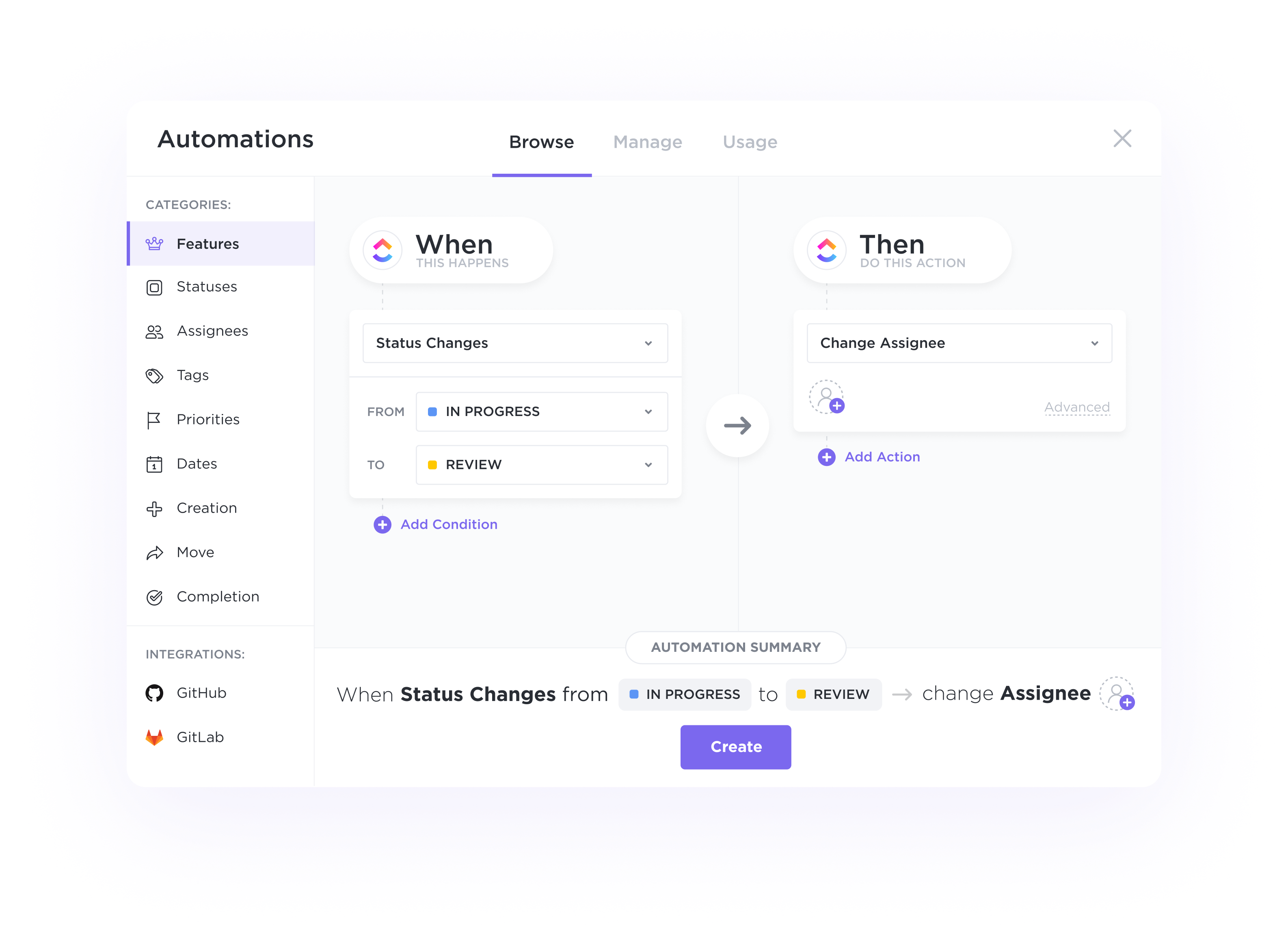

Automatically assign tasks for each stage of your pipeline, trigger status updates based on activity, and switch priorities to alert your team on where to focus next.

Efficiently capture and manage leads from various sources such as networking events or digital campaigns. Score leads based on criteria like investment potential or risk tolerance to prioritize follow-ups. By nurturing leads through the sales funnel, hedge fund managers can focus on converting high-quality prospects, leading to increased investor acquisitions.

Visualize the status of potential investments in a structured pipeline. Easily track where each investment opportunity stands in the due diligence process, from initial contact to closing the deal. This organized approach helps hedge fund managers identify bottlenecks, allocate resources effectively, and ultimately accelerate the investment cycle.

Analyze investor behavior patterns and preferences to tailor investment strategies and communications. By tracking how investors interact with fund offerings and market updates, hedge fund managers can gain valuable insights for personalized outreach. Real-time performance dashboards provide a comprehensive view of key metrics, aiding in strategic decision-making for maximizing investor satisfaction and retention.

Automate repetitive tasks like sending investment reports, scheduling investor meetings, or updating client profiles. By streamlining routine processes, hedge fund managers can focus on high-value activities such as investment research and client relationships. Automated alerts for upcoming investor meetings or regulatory deadlines ensure timely actions, enhancing operational efficiency and compliance adherence.

CRM software helps hedge fund managers streamline client communication and relationship management by centralizing client data, tracking interactions, automating communications, and providing insights for more personalized and strategic client engagement.

Hedge fund managers should look for CRM software that offers robust contact management, investor tracking, fund performance analysis, compliance monitoring, and customizable reporting capabilities to effectively manage client relationships and monitor investment activities.

Yes, CRM software for hedge fund managers can integrate with other tools and platforms used in the finance industry, such as portfolio management systems and trading platforms, to streamline data sharing, enhance operational efficiency, and provide a comprehensive view of client interactions and investment activities.