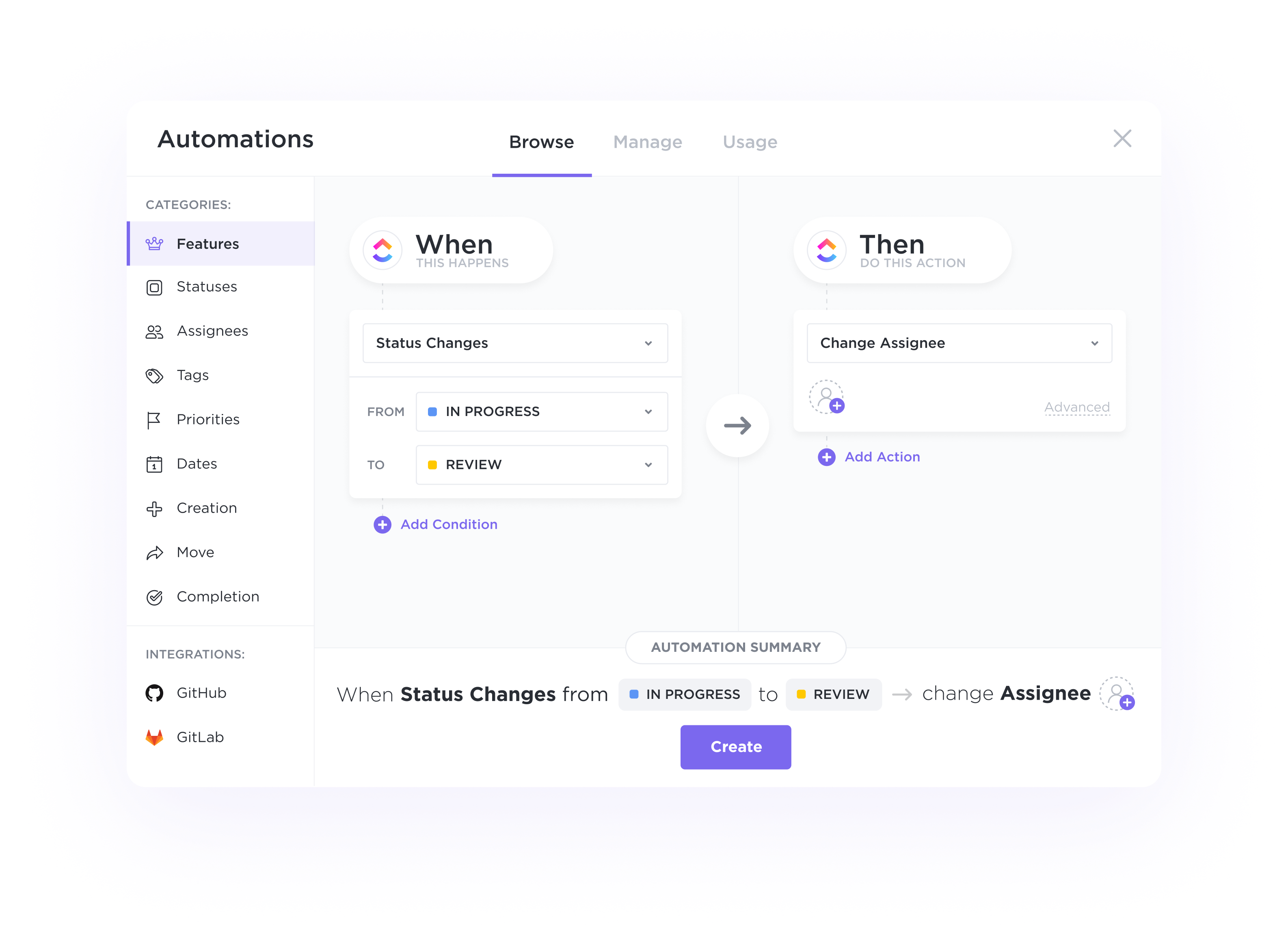

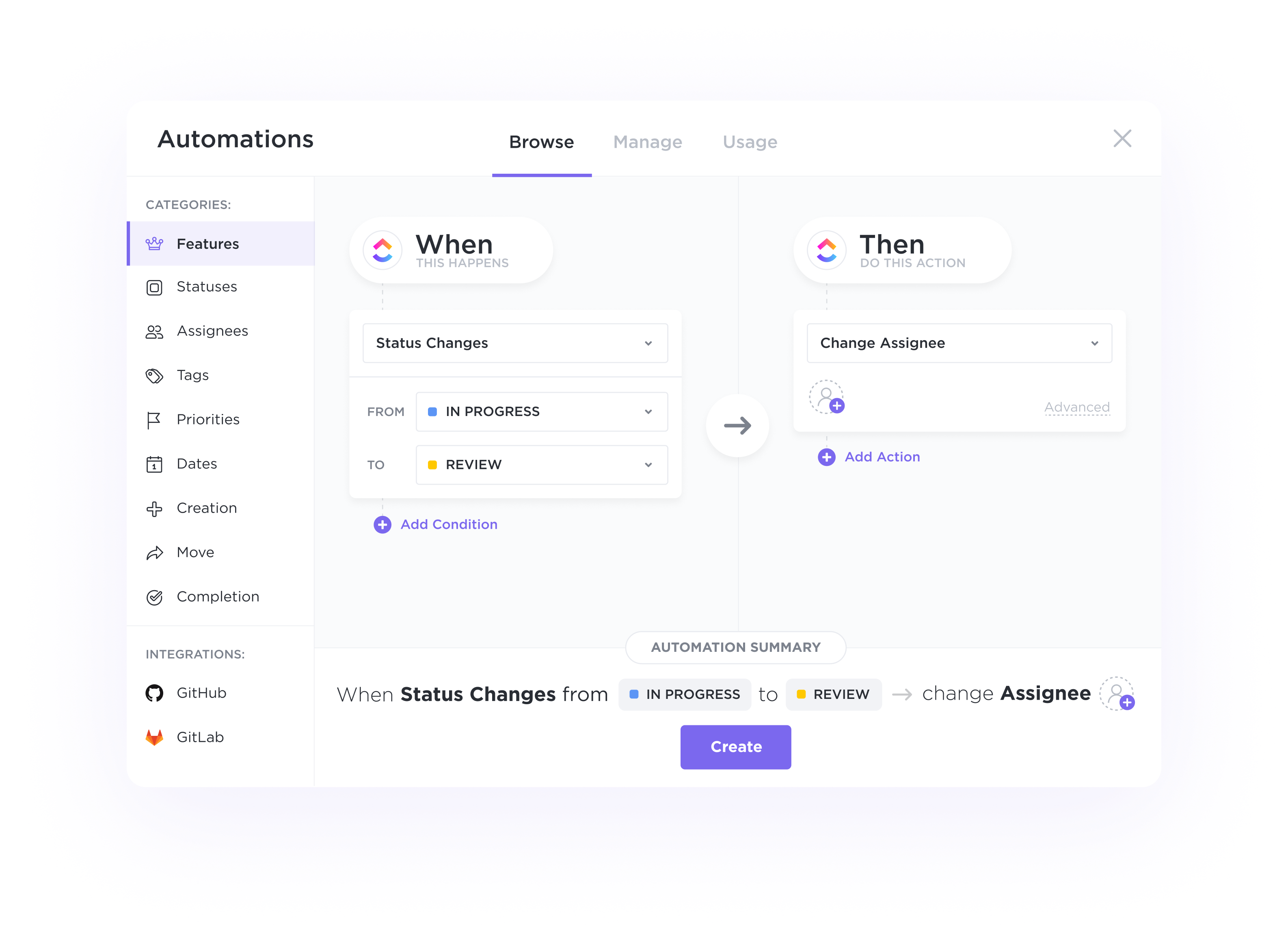

Automate handoffs, status updates, and more.

Automatically assign tasks for each stage of your pipeline, trigger status updates based on activity, and switch priorities to alert your team on where to focus next.

Supercharge your relationship management with ClickUp's tailored CRM system for Financial Advisors. Streamline client communications, track financial goals, and boost productivity all in one place. Revolutionize the way you manage your client relationships with ClickUp.

Free forever.

No credit card.

Trusted by the world’s leading businesses

Automatically assign tasks for each stage of your pipeline, trigger status updates based on activity, and switch priorities to alert your team on where to focus next.

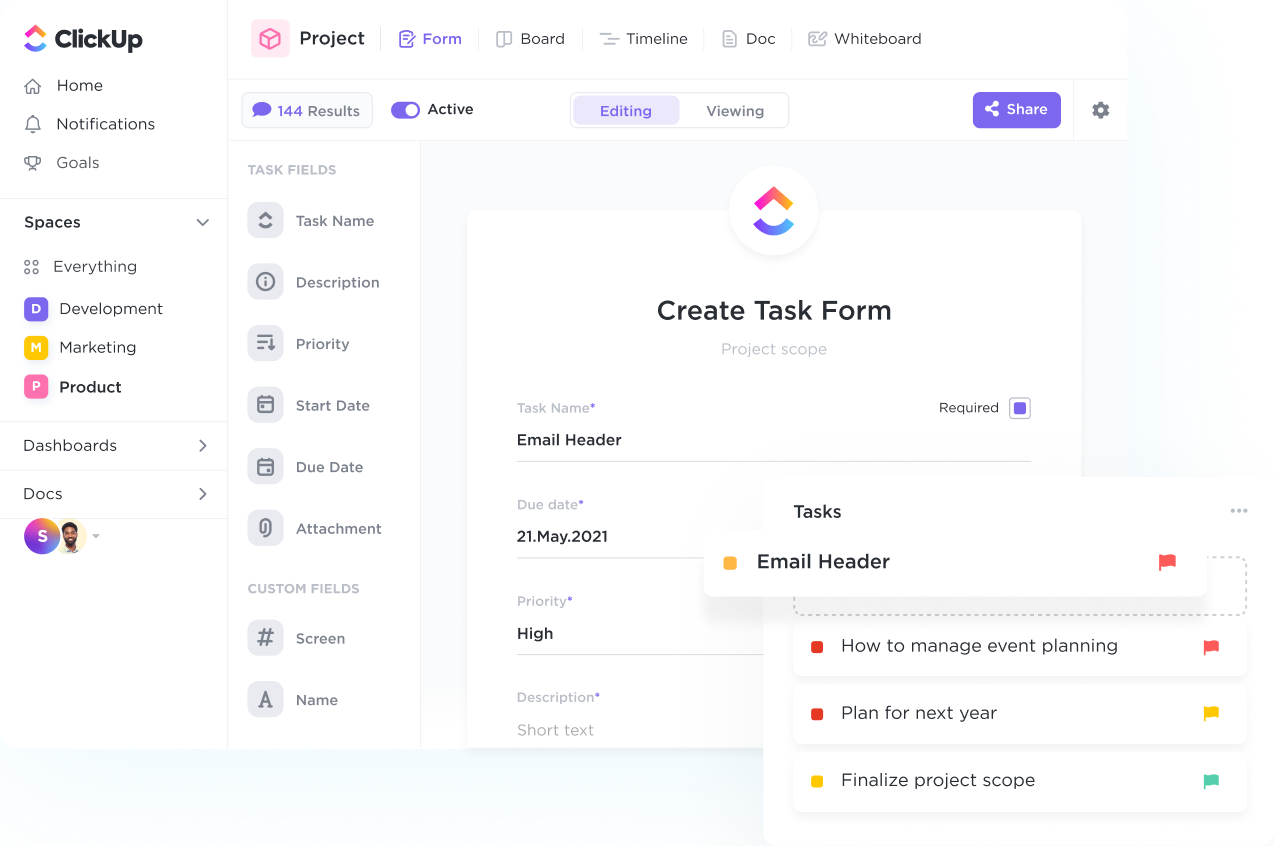

Streamline your intake process, organize response data, and automatically create tasks with custom branded Forms powered by conditional logic.

Key features of CRM software for financial advisors include client management, lead tracking, task automation, document management, and reporting. These features can benefit your practice by improving client relationships, streamlining workflows, enhancing productivity, and providing valuable insights for informed decision-making.

Yes, CRM software can streamline the client onboarding process by automating tasks, centralizing client information, and providing a structured workflow for improved efficiency and faster response times.

CRM software assists in tracking and managing client interactions by centralizing all communication, providing a holistic view of clients, automating tasks, and enabling personalized engagement, resulting in enhanced relationship management and client satisfaction.