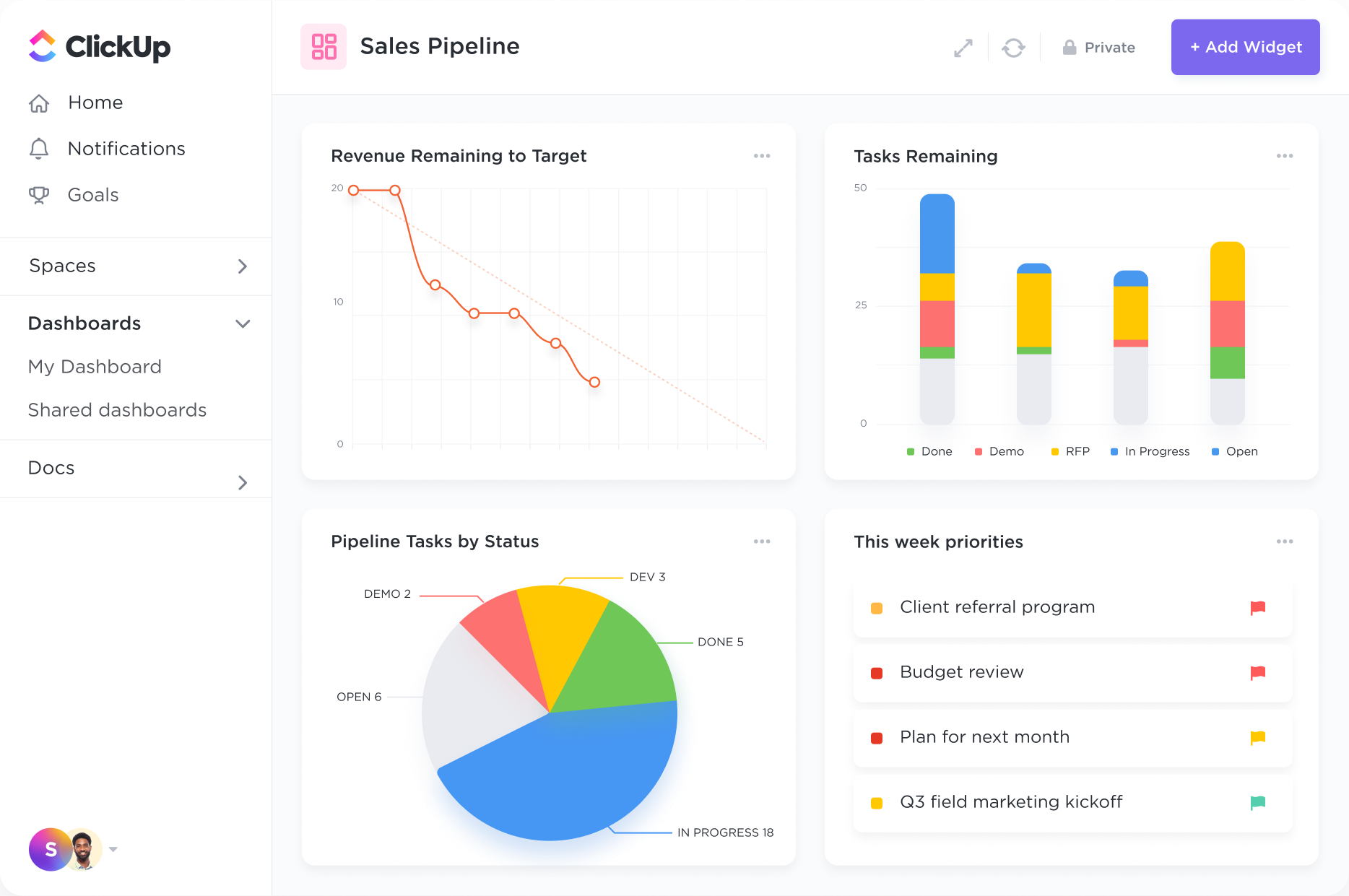

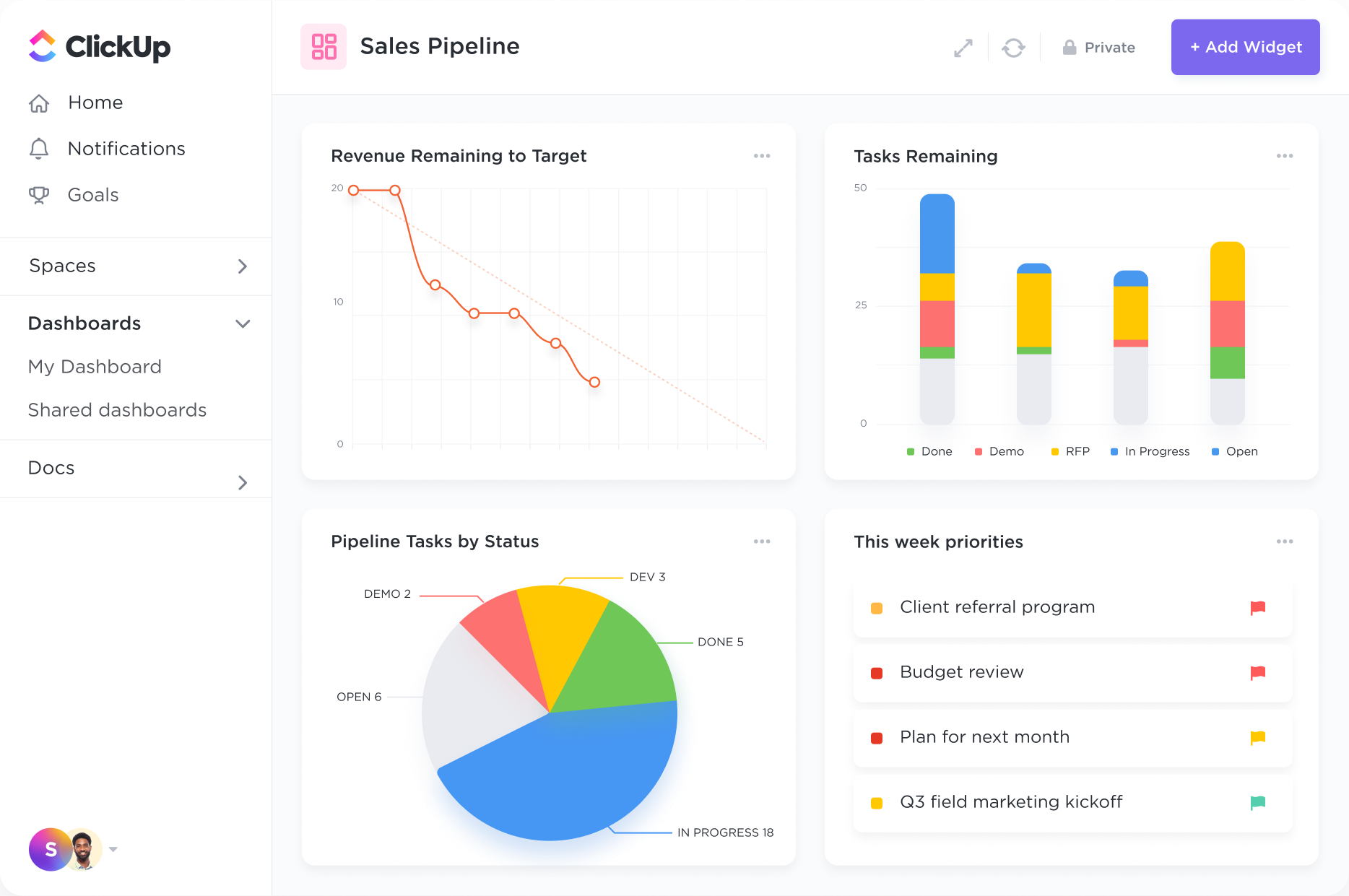

Analyze data for customer insights.

Create high-level views to monitor customer lifetime value, average deal sizes, and more. ClickUp's 50+ Dashboard widgets make it easy to visualize all of your customer data in one place.

Maximize efficiency and effectiveness in your debt collection process with ClickUp's customizable CRM system. Streamline communication, track interactions, and manage customer data seamlessly to boost productivity and improve client relationships. Take control of your debt collection strategy with ClickUp today.

Free forever.

No credit card.

Trusted by the world’s leading businesses

Create high-level views to monitor customer lifetime value, average deal sizes, and more. ClickUp's 50+ Dashboard widgets make it easy to visualize all of your customer data in one place.

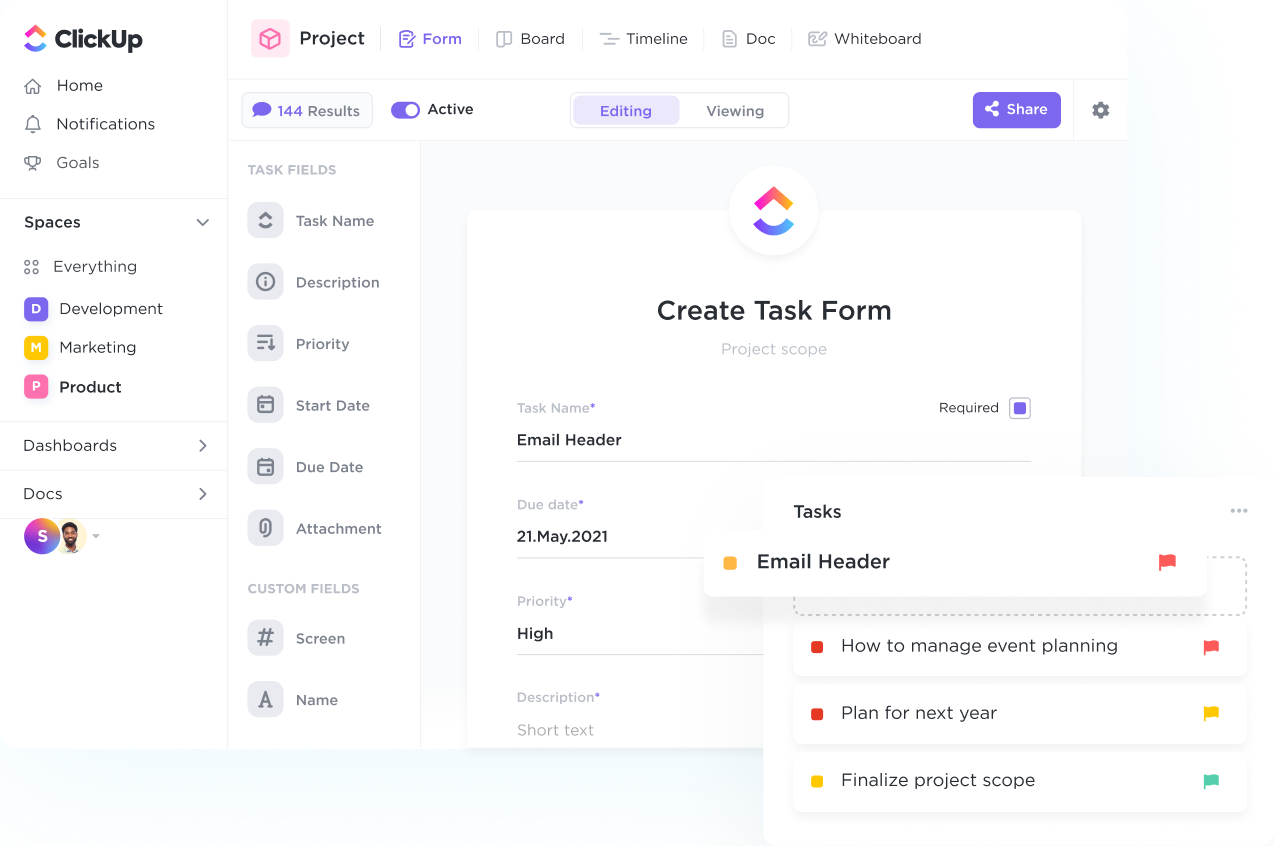

Streamline your intake process, organize response data, and automatically create tasks with custom branded Forms powered by conditional logic.

CRM software enables effective management and tracking of debt collection activities by centralizing customer information, automating follow-up reminders, creating detailed notes on interactions, and providing insights into payment histories and outstanding balances for improved debt recovery strategies.

Look for features in a CRM software for debt collection that include automated communication capabilities, robust reporting and analytics functionalities, customizable workflows for debt recovery processes, integration with payment gateways, and compliance management tools to ensure adherence to regulations.

Utilize CRM software to streamline debt collection processes, track customer interactions, automate reminders, personalize communication, and analyze data for better decision-making and strategy adjustments.