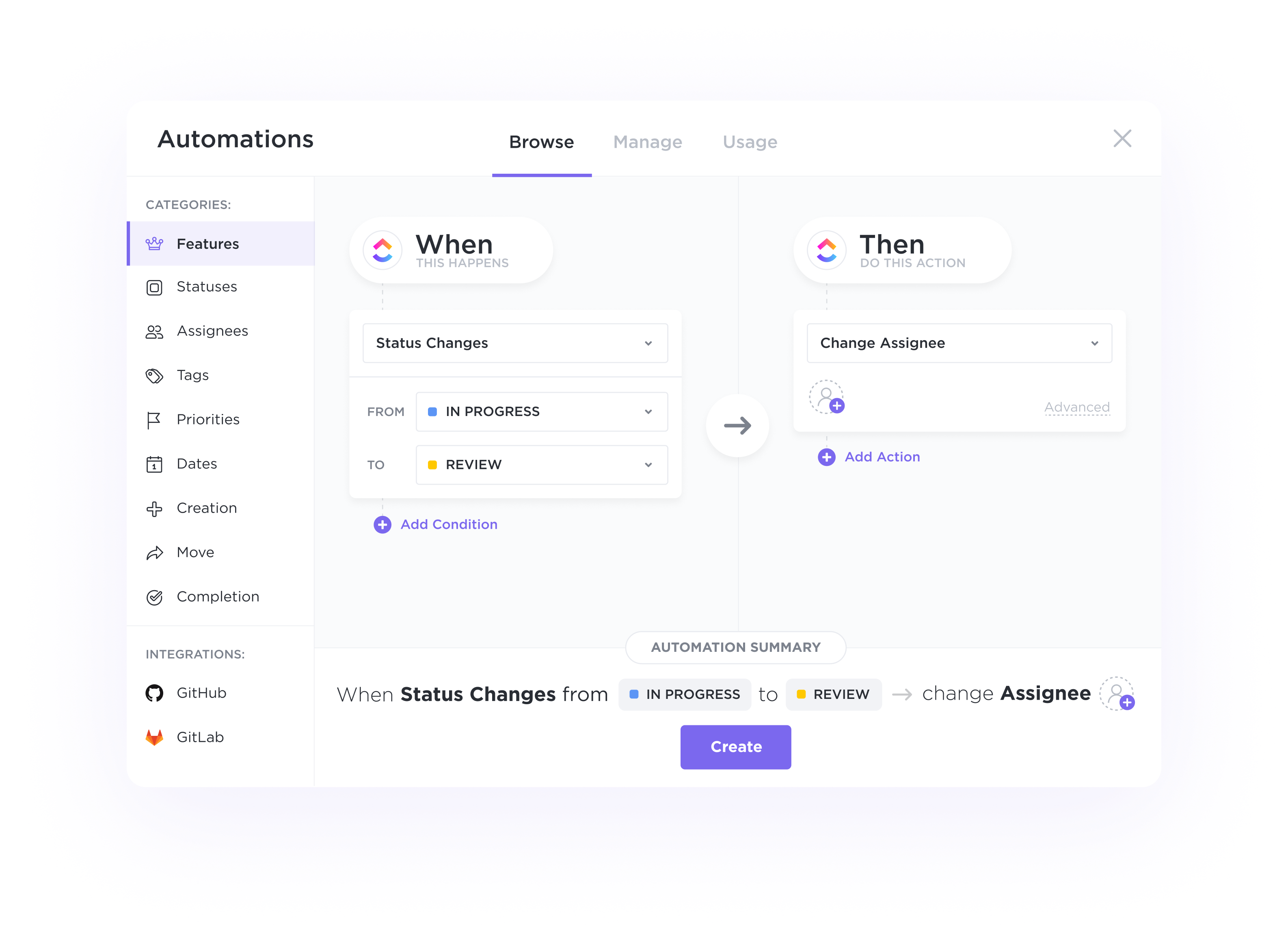

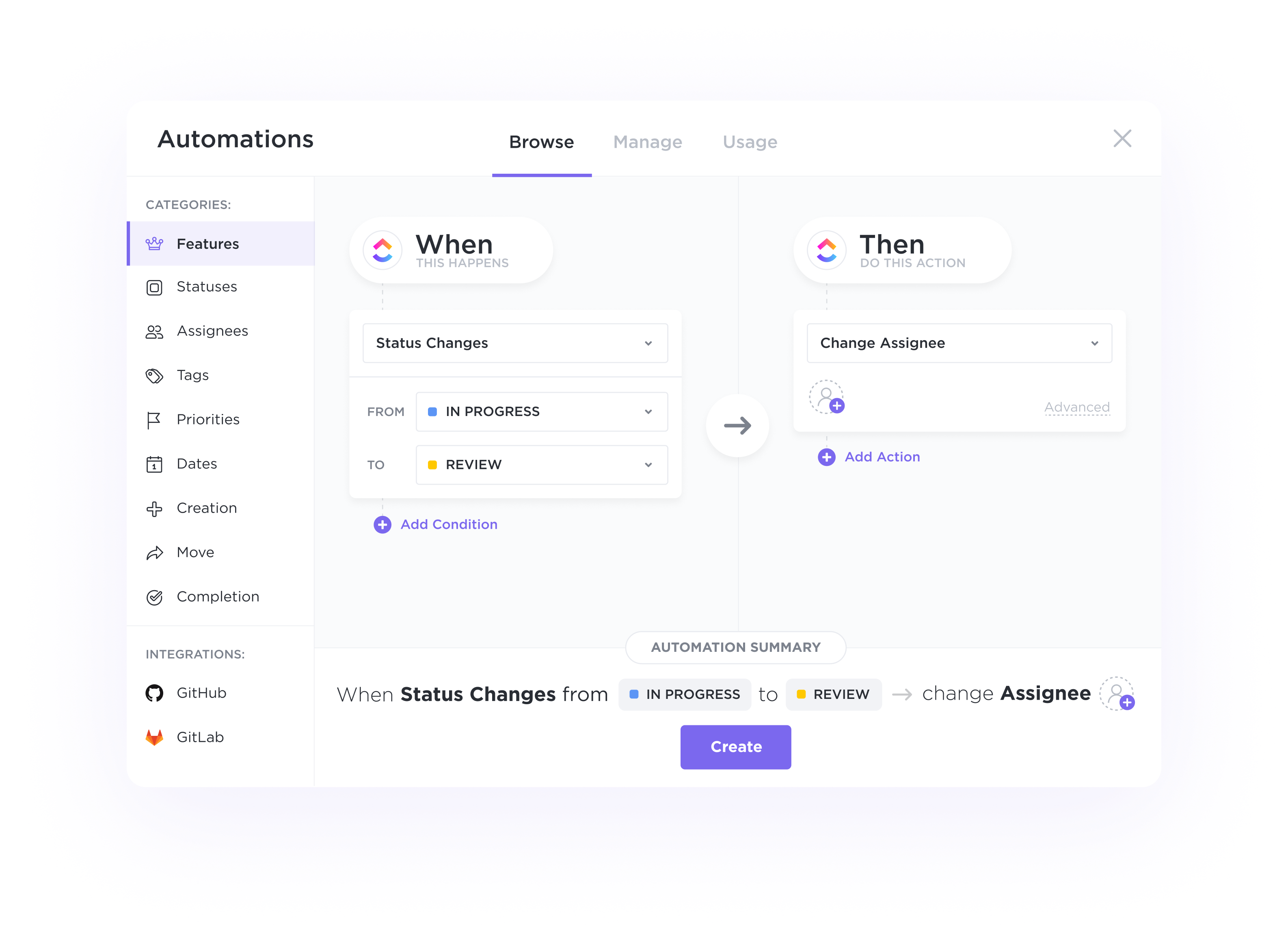

Automate handoffs, status updates, and more.

Automatically assign tasks for each stage of your pipeline, trigger status updates based on activity, and switch priorities to alert your team on where to focus next.

Revolutionize your brokerage business with a customized CRM system powered by ClickUp. Streamline client interactions, manage leads effortlessly, and boost productivity with our tailored solution. Maximize your efficiency and take your brokerage to new heights with ClickUp.

Free forever.

No credit card.

Trusted by the world’s leading businesses

Automatically assign tasks for each stage of your pipeline, trigger status updates based on activity, and switch priorities to alert your team on where to focus next.

Manage everything from sales pipelines, customer engagement, and orders with ClickUp's 10+ highly flexible views. Easily track and manage your accounts on a List, Kanban Board, Table view, and more.

Key features of CRM software that can benefit brokers include contact management for organizing client information, deal tracking to monitor sales progress, automation tools for streamlining tasks, reporting and analytics for performance insights, and integration capabilities for connecting with other tools and platforms.

CRM software can help brokers streamline lead generation and follow-up processes by centralizing lead information, automating follow-up tasks, providing lead scoring for prioritization, and enabling personalized communication based on lead interactions.

CRM software assists brokers by centralizing client information, tracking interactions, and automating follow-ups. This helps manage sales pipeline stages, prioritize leads, and ensure timely engagement for successful deal closures.