Top AI Prompts for Smarter Tax Planning

Harness AI Prompts to Enhance Tax Planning with ClickUp Brain

Mastering tax planning requires more than just numbers—it demands precision, foresight, and seamless coordination.

From gathering financial data to analyzing deductions, compliance reviews, and deadline tracking, effective tax management involves numerous details and documents. AI prompts are revolutionizing this process.

Tax teams leverage AI to:

- Quickly identify relevant tax codes and recent regulatory changes

- Generate detailed tax reports and filing checklists with minimal effort

- Simplify complex tax legislation into clear summaries

- Transform scattered notes into organized action plans and task lists

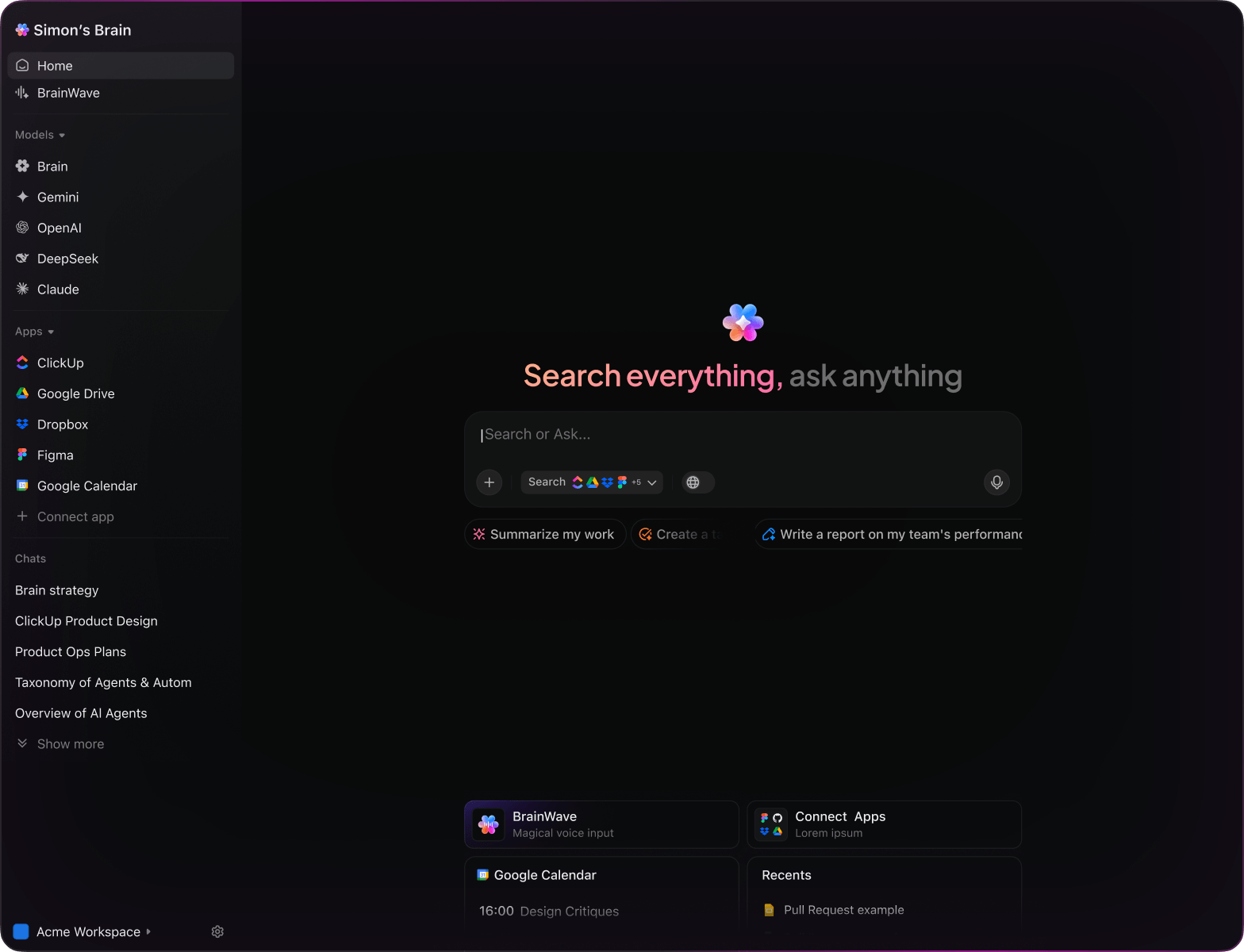

Integrated within familiar tools like documents, boards, and task trackers, AI in ClickUp Brain goes beyond assistance. It actively shapes your tax planning workflow into a streamlined, efficient operation.

Why ClickUp Brain Excels in Tax Planning

Standard AI Platforms

- Constantly toggling between apps to collect information

- Reiterating your tax objectives with every query

- Receiving generic, irrelevant suggestions

- Hunting through numerous systems for a single document

- Interacting with AI that only processes input passively

- Manually switching among different AI engines

- Merely a browser add-on without deep integration

ClickUp Brain

- Deeply connected to your tax tasks, files, and team communications

- Retains your planning history and specific targets

- Delivers detailed, context-aware guidance

- Offers consolidated search across all your resources

- Supports voice commands through Talk to Text

- Automatically selects the optimal AI model: GPT, Claude, Gemini

- Dedicated desktop app for Mac & Windows designed for efficiency

15 Essential AI Prompts for Tax Planning with ClickUp Brain

Identify five innovative tax-saving approaches for small enterprises based on the ‘2024 Tax Strategy Overview’ document.

ClickUp Brain Behavior: Analyzes key points and recommendations from the linked file to propose actionable tax strategies.

Outline current deductible expenses for US freelancers, referencing recent IRS guidelines and internal tax memos.

ClickUp Brain Behavior: Integrates insights from official documents and internal notes to highlight relevant deductions.

Generate a detailed checklist for corporate tax submission requirements, drawing from the ‘Q1 Compliance Guide’ and prior filing records.

ClickUp Brain Behavior: Extracts essential compliance steps and formats them into an actionable checklist.

Compare available tax credits for renewable energy projects using the ‘Incentives 2024’ document.

ClickUp Brain Behavior: Reviews tables and text to deliver a concise summary of applicable credits and eligibility.

Identify key functionalities preferred by tax professionals from internal surveys and software reviews.

ClickUp Brain Behavior: Aggregates recurring feature requests and performance notes into a clear list.

From the ‘Audit Readiness’ file, develop a structured risk evaluation form for tax audits.

ClickUp Brain Behavior: Extracts criteria and organizes them into a practical template for team use.

Summarize recent regulatory changes affecting global tax compliance from 2023-2024 reports.

ClickUp Brain Behavior: Identifies patterns and critical updates from linked legal documents and briefs.

Review the ‘Tax Filing Review 2023’ folder to pinpoint frequent mistakes and their causes.

ClickUp Brain Behavior: Extracts and categorizes error types to inform corrective actions.

Develop concise and friendly reminder messages based on the tone guidelines in ‘ClientComm.pdf’.

ClickUp Brain Behavior: Pulls style cues and suggests varied drafts tailored for different client segments.

Outline key updates in state tax regulations relevant to remote employees, referencing recent compliance documents.

ClickUp Brain Behavior: Condenses complex legal texts into digestible summaries for quick reference.

Extract best practices and documentation requirements from IRS publications and internal policy docs.

ClickUp Brain Behavior: Compiles rules and examples into a clear, step-by-step guide.

Using ‘Estimated Tax Payments Q&A’ and prior schedules, create a comprehensive task list for timely submissions.

ClickUp Brain Behavior: Identifies deadlines, forms, and calculation tips to ensure accuracy and compliance.

Summarize advantages and limitations of 401(k), IRA, and Roth plans from competitive analysis reports.

ClickUp Brain Behavior: Presents a balanced overview highlighting key features and tax implications.

Synthesize findings from recent surveys and industry reports on tax tech usage and innovation.

ClickUp Brain Behavior: Extracts insights on adoption rates, popular tools, and emerging capabilities.

Analyze feedback from tax teams in the ‘Workflow Feedback’ folder to uncover bottlenecks and inefficiencies.

ClickUp Brain Behavior: Prioritizes issues and suggests areas for process improvement.

AI Prompts for Enhancing Tax Planning with ClickUp Brain

ChatGPT Tax Planning Prompts

Gemini Tax Strategy Prompts

Perplexity Tax Insights Prompts

ClickUp Brain Tax Planning Prompts

Transform Tax Plans from Drafts to Details

- Convert initial tax notes into comprehensive strategies swiftly.

- Generate innovative approaches by analyzing previous filings.

- Build custom templates that accelerate your tax workflows.

Brain Max Boost: Quickly access historical tax documents, audit feedback, and financial data to guide your upcoming plans.

Accelerate Your Tax Planning Process

- Break down intricate tax strategies into straightforward, actionable tasks.

- Transform financial insights into organized, assignable workflows.

- Automatically create compliance reports and summary briefs without extra effort.

Brain Max Boost: Instantly access historical tax filings, deduction records, or audit notes across your portfolios.

Harness AI Prompts to Elevate Every Phase of Tax Planning

Create Strategic Tax Plans Quickly

Tax professionals explore diverse scenarios rapidly, enhance decision-making, and prevent planning bottlenecks.