Top AI Prompts for Financial Statement Review

Revolutionizing Financial Analysis with AI Prompts in ClickUp Brain

Interpreting financial statements goes beyond numbers—it’s about uncovering insights that drive smarter business decisions.

From balance sheets to cash flow reports, analyzing financial data requires precision, context, and timely action. That’s why AI prompts are becoming indispensable.

Finance teams leverage AI to:

- Quickly identify key financial trends and anomalies

- Generate clear summaries of complex reports

- Transform raw data into structured analyses and action plans

- Automate routine calculations and compliance checks

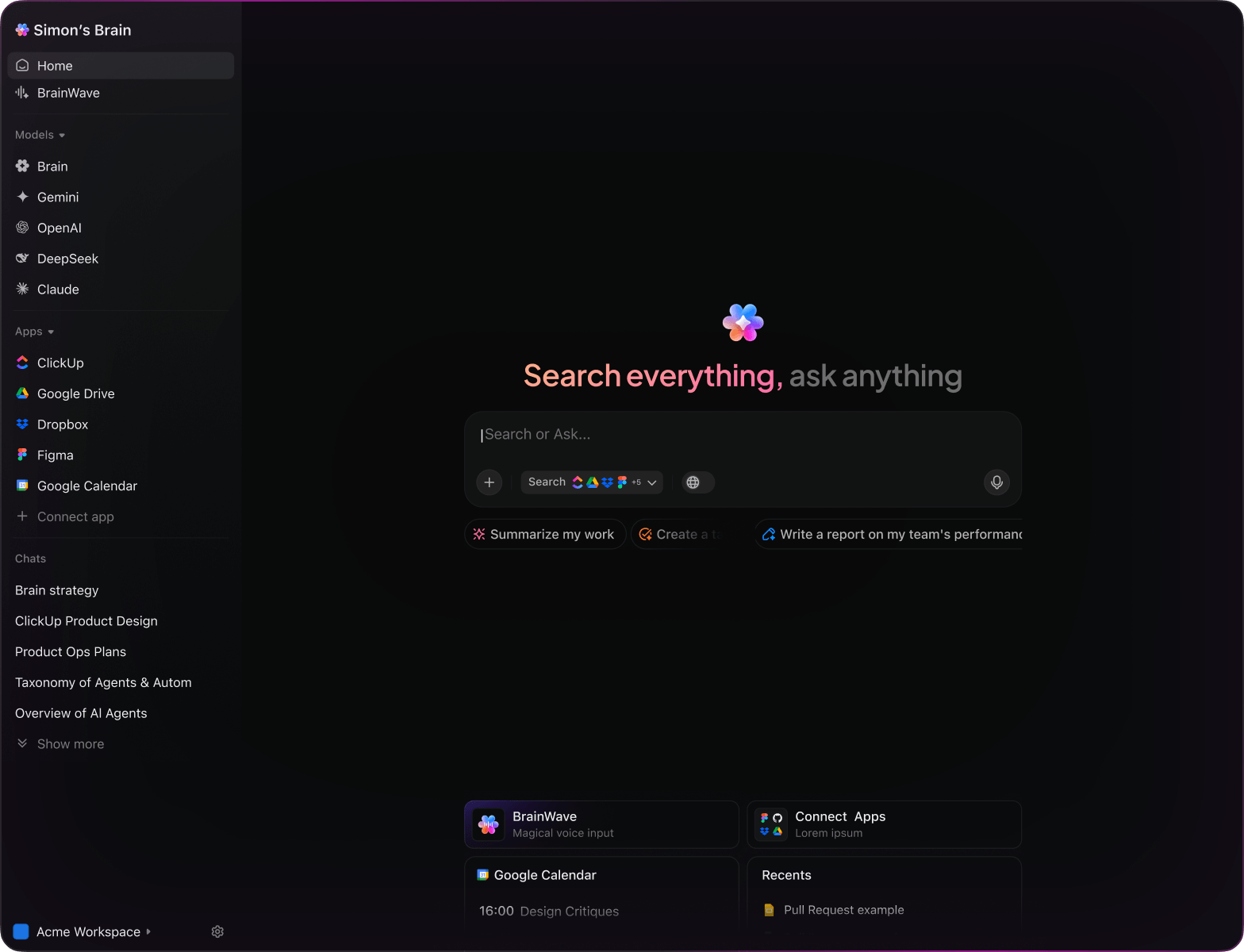

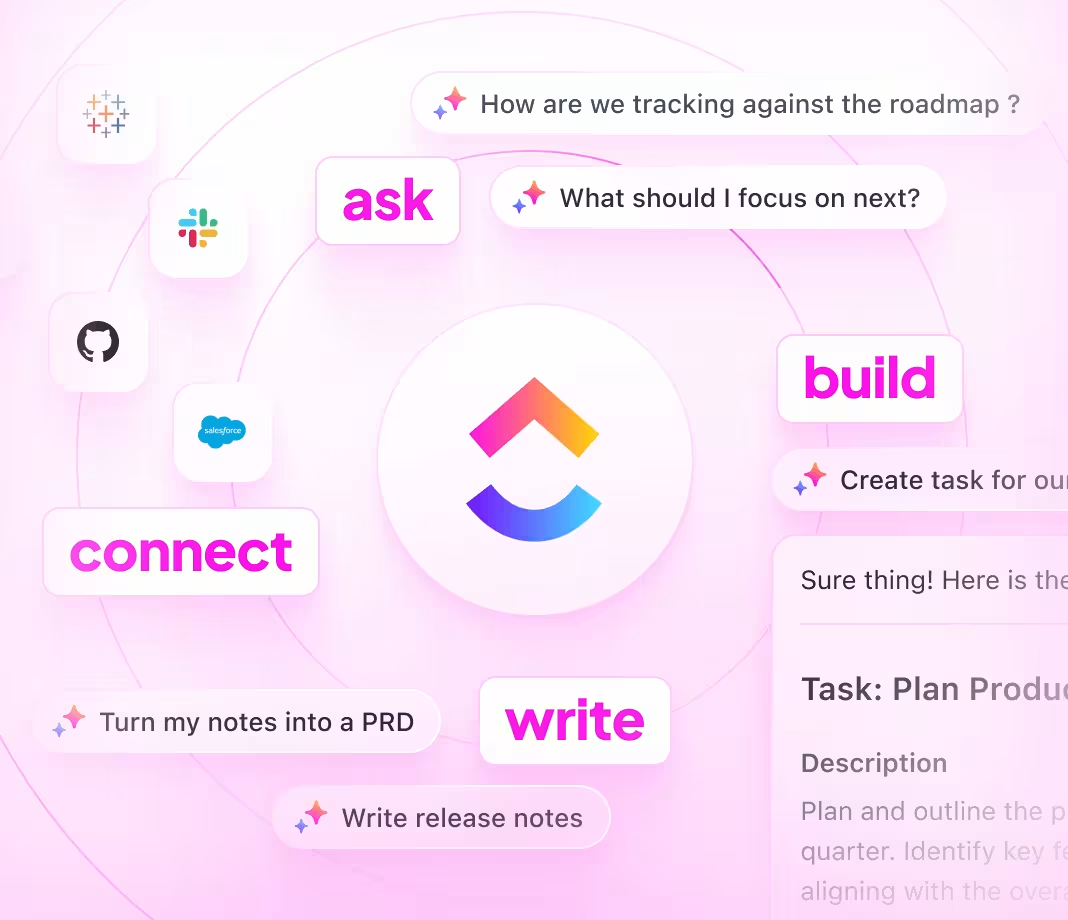

Integrated within familiar tools—such as documents, spreadsheets, and project trackers—AI in ClickUp Brain acts as a powerful partner, converting raw financial inputs into clear, prioritized tasks and strategic insights.

Why ClickUp Brain Stands Apart

Conventional AI Platforms

- Constantly toggling between apps to collect data

- Reiterating your objectives with each query

- Receiving generic, irrelevant feedback

- Hunting through multiple platforms for financial files

- Interacting with AI that only processes input

- Manually switching between different AI engines

- Merely a browser add-on without deep integration

ClickUp Brain

- Deeply connected to your financial reports, tasks, and team notes

- Tracks your analysis progress and objectives over time

- Provides detailed, context-aware insights

- Searches all your documents and data sources instantly

- Supports voice commands for hands-free operation

- Automatically selects the optimal AI model for your needs

- Dedicated desktop app for Mac & Windows optimized for performance

15 Essential AI Prompts for Financial Statement Analysis

Identify 5 key financial ratios from the ‘Q1 2024 Financials’ report that indicate company health.

ClickUp Brain Behavior: Analyzes linked documents to extract and explain critical financial metrics relevant to performance evaluation.

What are the latest trends in liquidity management for mid-sized firms in the US market?

ClickUp Brain Behavior: Gathers insights from internal financial research; Brain Max can supplement with current market data if accessible.

Draft a concise analysis summary for the income statement of ‘Company X’ using notes from the ‘Annual Report 2023’ and related financial documents.

ClickUp Brain Behavior: Pulls key figures and commentary from linked files to create a structured financial overview.

Compare debt-to-equity ratios between ‘Company A’ and ‘Company B’ based on the ‘Debt Analysis Q2’ document.

ClickUp Brain Behavior: Extracts numerical data and narrative insights to present a clear comparative summary.

List the predominant accounting policies affecting asset valuation in the ‘Financial Statements 2023’ folder.

ClickUp Brain Behavior: Reviews internal documents to identify and summarize accounting methods impacting reported figures.

From the ‘Audit Checklist 2024’ doc, generate a task list for verifying revenue recognition compliance.

ClickUp Brain Behavior: Detects audit points and formats them into actionable checklist items within a task or document.

Summarize 3 emerging risks in cash flow management identified in recent internal reports.

ClickUp Brain Behavior: Extracts recurring risk factors and patterns from linked financial risk assessments.

From the ‘Investor Feedback Q1’ doc, highlight main concerns regarding earnings volatility.

ClickUp Brain Behavior: Reviews survey data and feedback to pinpoint common investor apprehensions.

Write clear, concise explanatory notes for the equity section of the balance sheet, following the style guide in ‘FinanceTone.pdf’.

ClickUp Brain Behavior: Applies tone and style references to craft user-friendly financial disclosures.

Summarize recent changes in IFRS standards affecting revenue reporting and their implications.

ClickUp Brain Behavior: Condenses regulatory updates from linked compliance documents; Brain Max can add public updates if available.

Generate guidelines for segment reporting disclosures, referencing regional compliance documents stored in our workspace.

ClickUp Brain Behavior: Extracts relevant rules and formatting instructions to create a compliance checklist.

Create a checklist for internal controls over financial reporting based on the ‘SOX Compliance 2024’ folder.

ClickUp Brain Behavior: Identifies control requirements from documents and organizes them into categorized tasks.

Compare sustainability reporting practices related to financial disclosures among competitors using our analysis docs.

ClickUp Brain Behavior: Summarizes comparative data into an easy-to-read format, highlighting key differences and best practices.

What financial statement presentation trends have emerged in the tech sector since 2022?

ClickUp Brain Behavior: Synthesizes insights from industry reports, financial summaries, and uploaded research files.

Summarize key challenges in cash flow forecasting identified in the ‘SME Finance Feedback’ folder (accuracy, timing, assumptions).

ClickUp Brain Behavior: Extracts and ranks user-reported difficulties from surveys, feedback notes, and tagged issues.

LLMs vs. Workflow Intelligence: How ClickUp Brain Enhances Financial Analysis

Prompts for ChatGPT

Prompts for Gemini

Prompts for Perplexity

Prompts for ClickUp Brain

Transform Financial Data into Clear Insights

- Convert raw financial figures into comprehensive reports swiftly.

- Discover trends and anomalies by referencing historical statements.

- Build custom templates to accelerate your financial reviews.

Brain Max Boost: Effortlessly access previous analyses, audit notes, and financial models to guide your current evaluations.

Accelerate Financial Statement Analysis

- Break down detailed financial data into actionable insights.

- Transform raw numbers into organized, assignable tasks.

- Automatically create comprehensive analysis summaries without extra effort.

Brain Max Boost: Instantly access historical financial reports, ratio comparisons, or audit notes across all your projects.

How AI Prompts Elevate Every Phase of Financial Statement Analysis

Produce Insightful Reports Quickly

Analysts explore complex data faster, uncover key trends, and avoid analysis bottlenecks.