AI Tools for Accountants

Top AI Prompts Tailored for Accountants

Enhance accuracy, simplify reporting, and elevate your accounting processes with ClickUp AI.

Trusted by the world’s leading businesses

AI in Accounting

AI Prompts Revolutionizing Accounting Workflows

Accounting today demands precision, speed, and adaptability—not just in numbers but in managing complex workflows.

From transaction recording and tax preparation to audit trails and compliance reporting, accountants juggle numerous tasks alongside heaps of data and tight deadlines. AI prompts are now a game-changer in this landscape.

Accounting teams leverage AI to:

- Quickly identify relevant financial regulations and updates

- Generate draft reports, reconciliations, and tax documents with ease

- Extract key insights from dense financial statements

- Transform scattered notes into clear action plans, checklists, or task assignments

Integrated into familiar tools like documents, spreadsheets, and project boards, AI in ClickUp Brain doesn’t just assist—it actively organizes your accounting processes into clear, manageable steps.

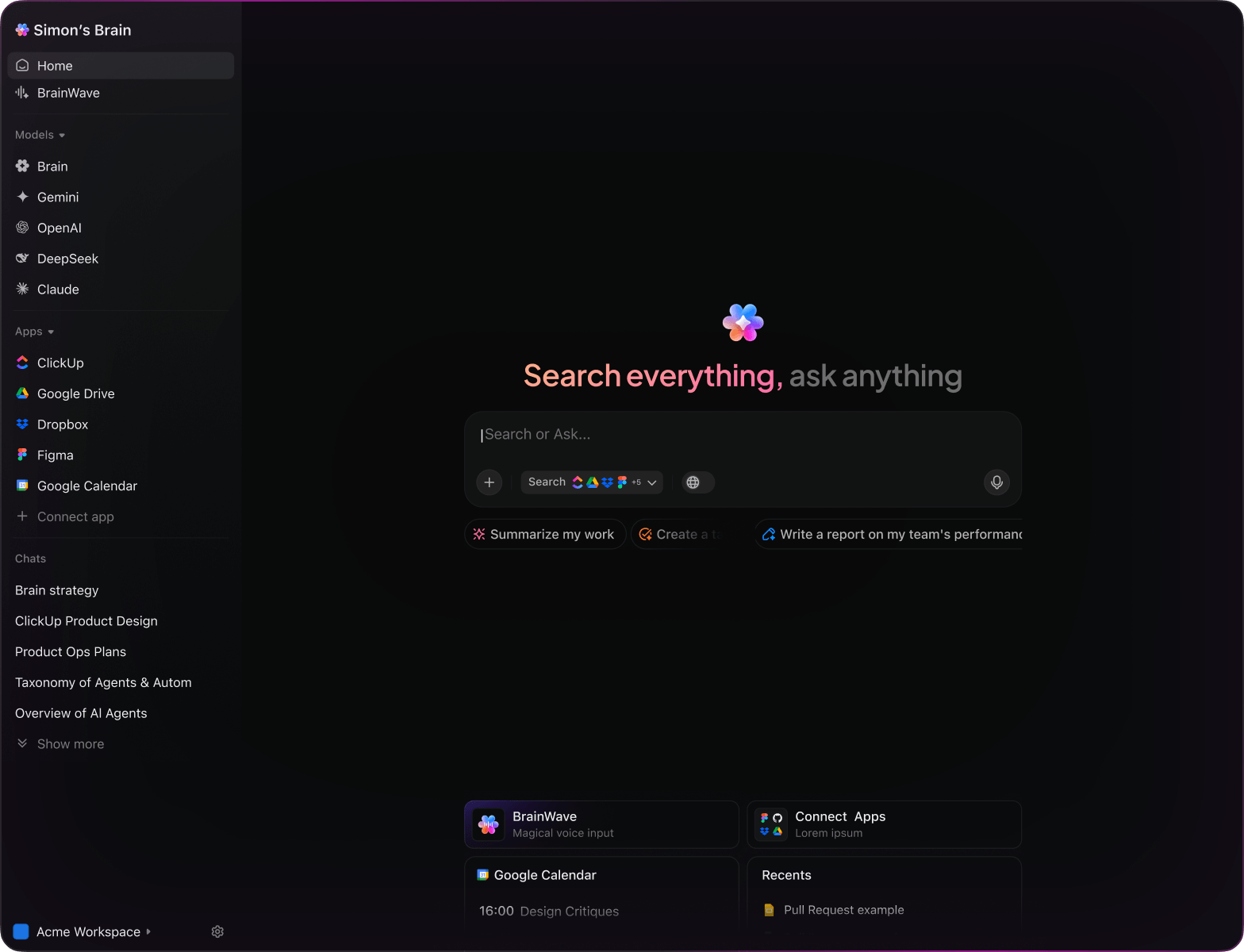

ClickUp Brain vs Conventional Solutions

Why ClickUp Brain Stands Out

ClickUp Brain integrates seamlessly, understands your workflow, and empowers you to act faster without repetitive explanations.

Conventional AI Platforms

- Constantly toggling between apps to find info

- Repeating your objectives with every query

- Receiving generic, irrelevant feedback

- Hunting through multiple systems for one document

- Interacting with AI that lacks initiative

- Manually switching between different AI engines

- Merely an added browser plugin

ClickUp Brain

- Deeply connected to your accounting tasks, files, and team communications

- Tracks your project history and targets

- Provides precise, context-driven guidance

- Offers a consolidated search across all your resources

- Enables voice commands with Talk to Text

- Automatically selects the optimal AI model: GPT, Claude, Gemini

- Dedicated Mac & Windows app designed for efficiency

AI Prompts for Accountants

15 Essential AI Prompts for Accounting Teams Using ClickUp Brain

Enhance accounting workflows—data analysis, compliance, and reporting simplified.

Identify 5 innovative bookkeeping strategies for small businesses, drawing insights from the ‘Q2 Financial Practices’ document.

ClickUp Brain Behavior: Reviews financial notes and summarizes effective bookkeeping methods tailored for small enterprises.

What are the latest compliance requirements for mid-sized firms under the new tax regulations?

ClickUp Brain Behavior: Analyzes internal compliance documents; Brain Max can supplement with current public tax codes if accessible.

Draft a client onboarding checklist for accounting services based on ‘Client Intake Procedures’ and previous workflow notes.

ClickUp Brain Behavior: Extracts key steps and formats a comprehensive onboarding guide from linked files.

Summarize audit comparison points between FY2022 and FY2023 reports using our ‘Annual Audit Review’ document.

ClickUp Brain Behavior: Pulls data and commentary from reports to deliver a concise audit year-over-year analysis.

List top software tools integrated with ClickUp for automating invoice processing, referencing vendor specs and internal evaluations.

ClickUp Brain Behavior: Scans documents to highlight frequently mentioned automation tools and their features.

From the ‘Expense Verification’ document, generate a task checklist for validating vendor invoices.

ClickUp Brain Behavior: Identifies verification criteria and structures them into actionable checklist items within a task.

Summarize 3 emerging trends in financial forecasting from recent market analysis and internal strategy documents.

ClickUp Brain Behavior: Extracts key insights and recurring themes from linked financial reports and notes.

From the ‘Client Feedback Q1’ document, summarize main concerns regarding billing transparency.

ClickUp Brain Behavior: Reviews survey data to identify common client feedback patterns and suggestions.

Write clear and engaging copy for the new expense approval notification, using tone guidelines from ‘CommunicationStyle.pdf’.

ClickUp Brain Behavior: References tone guide to craft concise and approachable notification messages.

Summarize recent changes in GAAP standards and their implications for revenue recognition.

ClickUp Brain Behavior: Reviews compliance documents and highlights key updates impacting accounting practices.

Generate guidelines for document retention periods, referencing regional compliance policies stored in our workspace.

ClickUp Brain Behavior: Extracts legal requirements and organizes them into a clear retention schedule checklist.

Create a risk assessment checklist for quarterly financial reviews using ‘Risk Management Framework’ PDFs and internal audit files.

ClickUp Brain Behavior: Identifies risk factors and compiles them into structured review tasks grouped by priority.

Compare tax deduction policies for freelancers across different states using our competitive tax analysis documents.

ClickUp Brain Behavior: Summarizes comparative data into an easy-to-read format highlighting key differences.

What are the latest trends in cloud accounting software adoption since 2023?

ClickUp Brain Behavior: Synthesizes market research and internal reports to outline adoption patterns and benefits.

Summarize common client challenges with payroll processing in the Southeast Asia region from feedback and support tickets.

ClickUp Brain Behavior: Extracts and prioritizes recurring issues reported by clients from various feedback sources.

Elevate Accounting Efficiency with ClickUp Brain

Cut down on revisions, unify your finance team, and produce superior results through AI-driven processes.

AI Prompts Tailored for Accountants with ClickUp Brain

Discover How ClickUp Brain Enhances Accounting Workflows Beyond Conventional AI Tools

Prompts for ChatGPT

- Outline a 5-step audit checklist focusing on compliance and risk mitigation for small businesses.

- Craft client communication templates emphasizing clarity and professionalism for tax season.

- Propose 3 budget forecasting scenarios for a mid-sized firm highlighting cash flow impacts.

- Develop a detailed workflow for month-end financial closing procedures.

- Compare last quarter’s expense reports and summarize key cost-saving opportunities.

Prompts for Gemini

- Design 3 alternative invoice templates optimized for clarity and client branding.

- Suggest innovative ways to visualize tax deductions for client presentations.

- Create a mood board description for a modern accounting dashboard focusing on usability and data clarity.

- Recommend ergonomic office setups for accounting teams to enhance focus and reduce fatigue.

- Compile a comparison chart of accounting software features tailored for small businesses.

Prompts for Perplexity

- List 5 emerging accounting regulations and rank them by impact on compliance workflows.

- Provide a comparison of bookkeeping methods for startups, highlighting efficiency and accuracy.

- Summarize global trends in financial reporting automation and adoption rates.

- Generate a list of 5 practical tips for managing remote accounting teams effectively.

- Analyze previous audit reports and extract top 3 recurring issues to address in future cycles.

Prompts for ClickUp Brain

- Transform this client feedback into prioritized accounting tasks with deadlines and assignees.

- Summarize meeting notes from the finance team and create follow-up action items.

- Review annotated financial statements and generate a checklist for compliance review.

- Compile a task list from cross-department discussions on budget revisions, including urgency levels.

- Summarize client consultation transcripts and produce actionable tasks for tax preparation and filing.

Why ClickUp Works for You

Transform Initial Thoughts Into Polished Plans

- Convert scattered notes into clear, actionable financial reports swiftly.

- Generate innovative accounting strategies by analyzing previous cases.

- Build customizable templates that accelerate your audit and tax workflows.

Brain Max Boost: Quickly access historical client data, audit comments, and financial documents to guide your upcoming projects.

Why Choose ClickUp

Accelerate Accounting Workflows Seamlessly

- Transform detailed financial reviews into straightforward task lists.

- Translate audit comments into actionable assignments effortlessly.

- Automatically produce comprehensive reports and client summaries without extra effort.

Brain Max Boost: Retrieve historical transaction data, client comparisons, or compliance notes instantly across engagements.

AI Advantages

How AI Prompts Elevate Every Phase of Accounting Workflows

AI prompts accelerate analysis and empower sharper, more accurate financial insights.

Quickly Develop Accurate Financial Models

Accountants explore diverse scenarios rapidly, enhance forecasting precision, and avoid analysis bottlenecks.

Enhance Decision-Making Confidence

Drive informed financial strategies, reduce compliance risks, and deliver reports clients and auditors trust.

Identify Errors Before They Escalate

Minimizes costly audit adjustments, boosts data integrity, and accelerates closing cycles.

Align Teams with Clear Financial Insights

Improves communication, prevents misunderstandings, and accelerates approvals across accounting, finance, and management.

Innovate Accounting Practices

Inspires creative solutions, implements cutting-edge methods, and maintains competitive advantage.

Integrated AI Support Within ClickUp

Transforms AI from a tool into an active partner that advances your accounting projects.

Boost Your Accounting Efficiency

Minimize mistakes, simplify collaboration, and generate insightful reports with AI support.