Transform banking operations with AI Agents, driving operational efficiency by automating repetitive tasks, analyzing vast data sets, and enhancing customer interactions with intelligent insights. ClickUp Brain ensures your team's focus stays sharp by managing complex workflows seamlessly, empowering your team to craft customer-centric banking solutions.

How AI Agents Work for Banking

In the fast-paced world of banking, AI Agents are transforming how financial institutions operate and interact with customers. These digital marvels streamline tasks, reduce human error, and enhance customer engagement, providing a smarter approach to banking.

Imagine AI Agents as your highly skilled virtual assistants, designed specifically for banking tasks. Whether it's personal banking, retail banking, or corporate banking, these agents have one goal: efficiency. Types of agents include Chatbots, which handle customer inquiries with ease, and Automated Advisors, offering investment or financial planning tips. Competitors have also rolled out Fraud Detection Agents, tirelessly monitoring transactions for any suspicious activity.

AI Agents excel in a multitude of banking scenarios. For instance, a Customer Service AI can provide 24/7 support, ensuring account information is always at the customer's fingertips. They can assist with password resets, balance inquiries, or transaction details without the need for human intervention. For the financial gurus out there, Automated Trading Agents analyze market trends in real-time, executing trades faster than any human could, and ensuring optimal returns. In essence, AI Agents in banking not only enhance operational efficiency but also contribute significantly to improving the customer experience.

Benefits of Using AI Agents for Banking

Banking is evolving faster than ever, and AI Agents are right at the forefront, revolutionizing the way banks operate and interact with their customers. Here’s a look at some of the incredible benefits:

1. Enhanced Customer Service

AI Agents handle customer inquiries instantly, providing 24/7 support. They can resolve common issues and answer frequently asked questions, freeing up human staff to tackle more complex tasks. Customers get quick, accurate responses, leading to happier clients and stronger relationships.

2. Fraud Detection and Prevention

AI Agents swiftly analyze transaction patterns to identify suspicious activities. They’re constantly learning from new data, becoming more adept at spotting anomalies. This proactive approach significantly reduces the risk of fraud, protecting both the bank and its customers.

3. Personalized Banking Experience

With AI Agents, banks can offer personalized product recommendations by analyzing customer data. These agents understand individual preferences and financial behaviors, delivering tailor-made solutions and marketing messages that resonate with each customer, enhancing satisfaction and loyalty.

4. Cost Efficiency

By automating routine tasks, AI Agents reduce operational costs. Banks can allocate resources more strategically, potentially investing savings back into innovative solutions or enhancing customer experiences. It's a win-win situation for both banks and their clientele.

5. Improved Data Management

AI Agents streamline data processing and analysis, making it easier for banks to extract valuable insights. From predicting market trends to understanding customer needs, data-driven decisions become quicker and more accurate, boosting overall business intelligence.

Embrace the power of AI Agents in banking and enjoy a smarter, more efficient way of doing business. Your customers—and your bottom line—will thank you!

AI Agents in Banking: Transforming the Financial Landscape

Harness the power of AI Agents to revolutionize the way banking operates. From enhancing customer support to optimizing internal processes, here are practical applications and scenarios where AI agents can be a game-changer for banking.

Customer Service

- 24/7 Support: AI agents can provide round-the-clock assistance, answering customer queries outside of traditional banking hours.

- Personalized Recommendations: Analyze customer data to suggest tailored financial products or services.

- Fraud Detection: Promptly identify suspicious activities and alert customers to potential security threats.

- Complaint Resolution: Streamline the handling of customer grievances, ensuring swift and effective solutions.

Financial Management

- Budgeting Assistance: Help customers track their spending habits and provide insights for better financial planning.

- Investment Advice: Offer data-driven recommendations for stocks, bonds, or other financial instruments based on market trends.

- Loan Processing: Expedite the loan approval process by analyzing credit scores and other relevant criteria.

Operational Efficiency

- Automated Reporting: Generate financial reports and analytics with minimal manual input, saving time and reducing errors.

- Compliance Monitoring: Ensure adherence to regulatory requirements by automating compliance checks and audits.

- Transaction Processing: Speed up back-end operations by automating repetitive tasks like transaction verification.

Security Enhancements

- Authentication: Use voice or facial recognition for secure customer access to accounts.

- Risk Assessment: Continuously evaluate the risk profile of transactions and accounts to preempt any fraud attempts.

Marketing and Sales

- Lead Generation: Identify potential clients through data analysis and engage them with personalized outreach.

- Cross-selling and Upselling: Recognize opportunities to offer additional products based on a customer's current portfolio and behavior.

Employee Empowerment

- Training and Development: Provide interactive training modules and support for new banking software or policies.

- Task Automation: Reduce time spent on repetitive administrative tasks, allowing staff to focus on more strategic areas.

With AI agents, the banking sector can not only improve efficiency and security but also deliver a more personalized and satisfying experience for both customers and employees. Embrace the future of banking today!

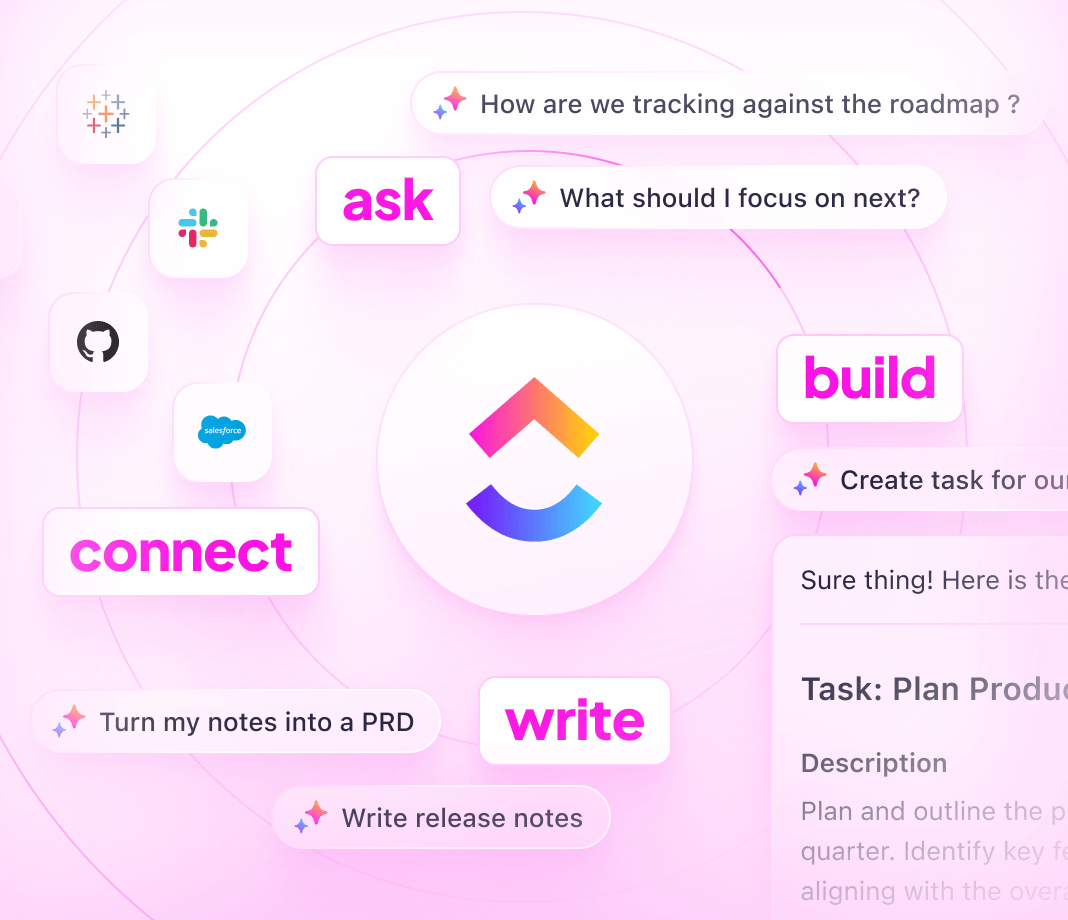

Unlock New Levels of Efficiency with ClickUp Brain Chat Agents

Imagine a magical assistant in your Workspace, ready to streamline your day and tackle tasks with flair. Enter ClickUp Brain Chat Agents – chat-savvy, goal-oriented, and oh-so-capable. Whether you're managing a bustling project or handling queries, these Agents have got you covered.

Why Use Chat Agents?

Picture this: you're navigating a sea of conversations and tasks within your Workspace. Chat Agents are here to ensure nothing gets lost in the shuffle. They adapt, react, and proactively manage tasks, making your work life a breeze. Here's how they can make a difference:

What Can Chat Agents Do?

Answer Questions with Precision: The Answers Agent is your go-to for handling inquiries about your product, services, or organization. It taps into specified knowledge sources to deliver accurate responses, saving you from repeated explanations.

Streamline Task Management: The Triage Agent ensures that crucial tasks are linked to relevant Chat threads. It sifts through conversations using criteria you set, and highlights discussions that require follow-up action.

Customize Your Chat Agents

Flexibility? Check. Chat Agents come with predefined prompts you can tweak to suit your Workspace needs. Whether it's assisting in managing routine banking inquiries or helping spot tasks linked to conversations, your Chat Agents are ready to roll up their sleeves and get to work.

Real-Time, Goal-Driven Interaction

Once activated, Chat Agents spring into action, making decisions and responding to real-time changes within your Workspace. Their goal-oriented nature ensures they actively seek out ways to optimize your processes and cut down on manual input.

Banking on Efficiency

For scenarios like a banking AI Agent, think of Chat Agents as the behind-the-scenes wizards, autonomously navigating organizational tasks and conversations. They leave you free to focus on providing top-notch customer interactions while they handle the nitty-gritty details.

Leverage the power of ClickUp Brain Chat Agents to supercharge your Workspace operations. Streamline communication, automate responses, and transform how your team collaborates—all with a sprinkle of AI magic!

Navigating Challenges with Banking AI Agents

Banking AI agents are revolutionizing the way financial institutions operate, enhancing customer service, streamlining processes, and improving decision-making. While the potential is enormous, there are a few challenges and considerations to keep in mind. Here’s how you can address them head-on.

Common Pitfalls and Solutions

Data Privacy and Security Concerns

- Challenge: Handling sensitive customer data can be risky with AI agents.

- Solution: Implement robust encryption and adhere strictly to data protection regulations like GDPR. Regular security audits and updates can further bolster defenses.

Bias and Fairness

- Challenge: AI agents might inadvertently perpetuate or amplify biases present in training data.

- Solution: Use diverse datasets and implement bias-detection tools. Regularly evaluate AI decisions to ensure they meet fairness standards.

Integration with Legacy Systems

- Challenge: AI agents sometimes struggle to integrate with outdated banking infrastructure.

- Solution: Invest in middleware solutions that facilitate communication between AI systems and legacy systems. Gradual modernization of infrastructure can also ease the integration process.

Regulatory Compliance

- Challenge: The regulatory environment in banking is complex and ever-changing.

- Solution: Build AI models with compliance in mind, and stay proactive by keeping abreast of regulatory updates. Collaborate with legal teams to ensure AI activities align with current laws.

Customer Trust and Acceptance

- Challenge: Customers may be apprehensive about interacting with AI agents.

- Solution: Ensure transparency by clearly communicating the role and capabilities of AI agents. Providing seamless support and the option to escalate to human agents can reassure customers of reliability and authenticity.

Limited Understanding of Nuances

- Challenge: AI agents might miss the subtle nuances of human interactions.

- Solution: Continuously train models on diverse interaction types and incorporate sentiment analysis tools to better grasp customer emotions and contexts.

Overcoming Limitations

Enhance Training: Regularly update AI models with new data and scenarios to improve their adaptability and accuracy.

Human-AI Collaboration: Encourage a symbiotic relationship where human expertise complements AI efficiency, especially for complex decision-making tasks.

Feedback Loops: Establish mechanisms for collecting customer and employee feedback on AI interactions. Use this information to fine-tune algorithms for better performance.

By proactively addressing these challenges and limitations, your banking AI agents can operate with greater efficiency, trust, and compliance. Embrace these solutions to build a more robust and customer-friendly banking experience.