Transform wealth management with AI Agents that simplify tracking, analyze financial trends, and inspire smarter investment decisions. ClickUp Brain ensures your financial plans are intuitive and adaptable, keeping you ahead in the fast-paced world of wealth management.

Wealth Tracking AI Agent: Your Personal Financial Assistant

AI Agents for wealth tracking provide a personalized financial assistant that takes the guesswork out of managing your finances. These smart tools help track investments, monitor spending, and offer insights into your financial health—all from a single dashboard. Imagine having a savvy financial advisor in your pocket, ready to provide guidance whenever you need it.

Types of AI Agents for Wealth Tracking:

- Competitor Analysis Agents: Monitor industry trends, analyze competitors' financial positions, and provide insights into market shifts.

- Financial Task Managers: Automate routine financial tasks, such as budgeting, expense tracking, and investment management to keep your financial goals on track.

- Role-specific Agents: Tailor financial advice and planning based on your specific roles, such as being an investor, a business owner, or an individual budgeting for household expenses.

How Wealth Tracking AI Agents Work:

Imagine you’re juggling multiple investment accounts, a retirement plan, and a growing list of monthly expenses. A wealth tracking AI agent can automate the nitty-gritty details—like categorizing transactions, generating reports, and alerting you to unusual spending patterns. For example, an AI could inform you that your grocery spending is 15% above average this month, offering suggestions for savings based on past spending behavior.

These agents also monitor real-time market data and financial news, helping you make informed investment decisions. They can alert you to emerging trends or new investment opportunities that match your portfolio goals. From rebalancing your investment portfolio to ensuring you're on track for retirement savings, AI agents aim to simplify the complexities of financial management, letting you focus on making strategic decisions without getting bogged down by data analysis.

Benefits of Using AI Agents for Wealth Tracking

Harness the power of AI Agents for wealth tracking and experience transformative changes in how you manage and grow your financial assets. Below are some of the key benefits:

Real-Time Monitoring

- Stay updated with your financial data at any time. AI Agents provide instant access to account balances, investment performance, and spending patterns, helping you make informed decisions on the fly.

Data-Driven Insights

- Transform raw data into valuable insights. AI Agents analyze trends and behaviors, offering you actionable recommendations on budget adjustments or investment opportunities, ensuring your wealth grows effectively.

Personalized Financial Strategies

- Let AI tailor strategies to fit your unique financial goals. By assessing your income, expenses, and risk appetite, AI Agents can suggest personalized plans that align with your short-term and long-term objectives.

Automated Alerts and Notifications

- Never miss critical financial updates. AI Agents send timely alerts for account activity, due payments, and market shifts, enabling you to react promptly and protect your assets.

Enhanced Security

- Benefit from sophisticated security protocols. AI Agents monitor for unusual transactions and potential fraud, providing an additional layer of protection to keep your financial data safe.

AI Agents in wealth tracking pave the way for a smarter, more efficient approach to financial management, offering you the peace of mind and strategies you need to achieve your financial aspirations.

AI Agents for Wealth Tracking: Practical Applications

Are you ready to transform your financial management? Let's look at how AI agents can be your trusty sidekick in wealth tracking. From analyzing spending habits to handling investments, these agents are designed to make your financial life simpler and more efficient.

Practical Applications of Wealth Tracking AI Agents

Automated Budget Monitoring

- Set custom spending limits and receive instant alerts when you're approaching them.

- Get a summary of your spending habits and align them with your financial goals.

Investment Portfolio Management

- Receive recommendations based on current market trends and your personal risk appetite.

- Analyze past investment performances to make informed decisions about buying, holding, or selling assets.

Expense Categorization

- Automatically sort transactions into categories like groceries, entertainment, and utilities.

- Generate insights on which categories consume most of your income.

Financial Goal Tracking

- Set short-term and long-term financial goals and monitor your progress toward achieving them.

- Get personalized suggestions to accelerate goal accomplishment.

Debt Management

- Stay on track with loan and credit card payments by setting up reminders and automatic payments.

- Generate strategies to reduce debt effectively based on your income and expenditure patterns.

Tax Optimization

- Identify potential tax deductions and credits based on your expenses.

- Help in organizing necessary financial documents for hassle-free tax filing.

Scenarios Where AI Agents Shine

Real-Time Financial Updates

- Access instant updates on your financial status, providing peace of mind and helping you make timely decisions.

Fraud Detection

- Enhance security by highlighting unusual spending patterns and unauthorized transactions.

Cash Flow Analysis

- Monitor your inflow and outflow to ensure you maintain a healthy cash reserve.

Customized Financial Reports

- Generate comprehensive reports that offer insights into your financial health, complete with graphs and charts.

Harness the power of AI agents to manage your wealth with precision and ease. With these digital assistants at your side, streamlining your financial journey has never been more attainable or enjoyable!

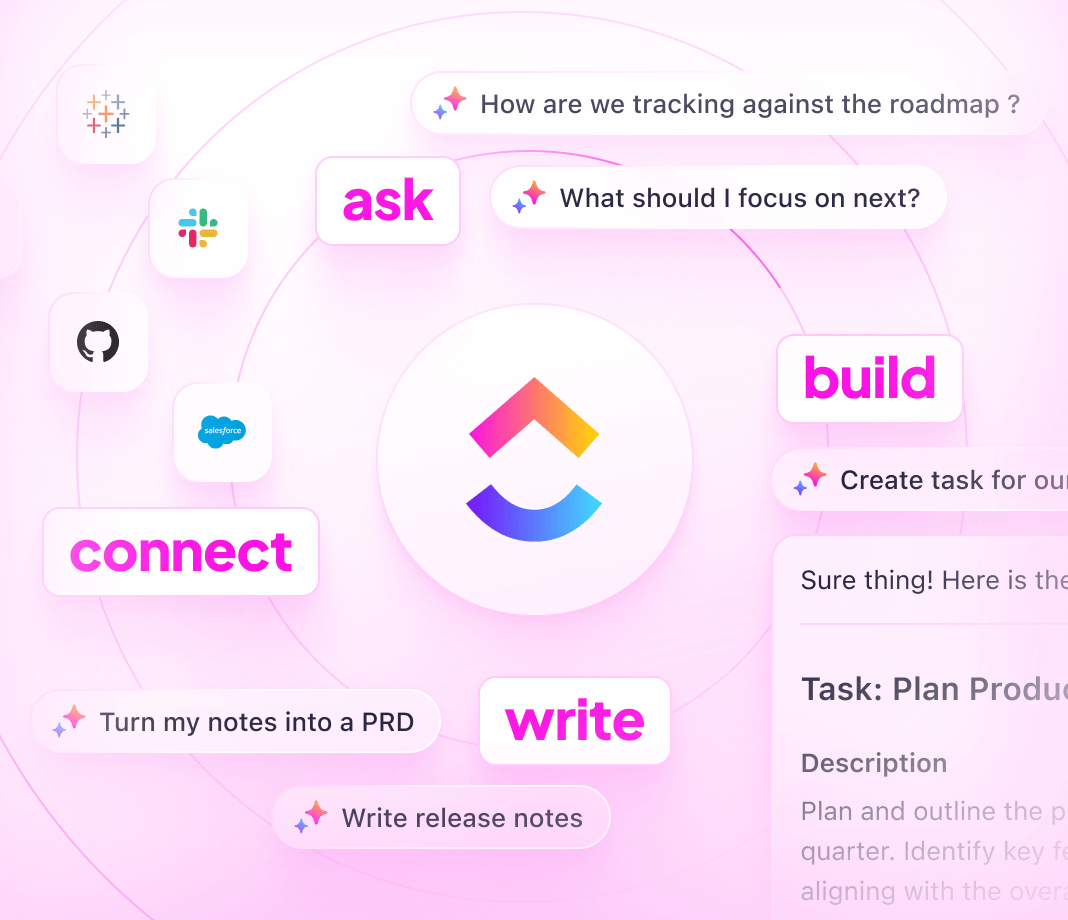

Leverage ClickUp Brain Chat Agents in Your Workspace

Unleash the potential of ClickUp Brain's Chat Agents and watch as your productivity gets a mighty boost! Whether you're streamlining task management or speeding up communication, Chat Agents transform your ClickUp Workspace into a dynamic and interactive environment.

Supercharge Your Team Communication

Chat Agents are like the friendly neighborhood superheroes of your Workspace, ready to assist and engage. Imagine having an Answers Agent that steps in to autonomously answer team queries about your product or services. No more waiting for responses. The Answers Agent taps into specified knowledge sources to offer speedy solutions, freeing up time for more strategic tasks.

Stay on Top of Action Items with Ease

In the hustle and bustle of daily operations, it's easy to miss crucial actions buried in chat threads. Enter the Triage Agent! This proactive agent swoops in to ensure no task-worthy chats slip through the cracks. By linking relevant tasks to conversations, it keeps everyone aligned and in-the-know with the necessary context.

Customizable Agents Tailored to Your Needs

The beauty of Chat Agents lies in their flexibility. Whether you’re setting up an Answers Agent or Triage Agent, customization is at your fingertips. Tailor the agents to suit your team’s unique needs and watch them function as an integrated part of your team.

Looking to Track Wealth?

If your focus is managing wealth and ensuring all pertinent financial tasks are handled efficiently, consider how a Chat Agent might assist. Configuring these agents to respond to wealth-related queries or managing tasks connected to financial discussions can keep your wealth tracking seamless.

Transform your ClickUp Workspace with Chat Agents and experience a new level of operational excellence. Embrace the future of productivity!

Navigating the Challenges of Using AI Agents for Wealth Tracking

AI Agents for wealth tracking can feel like having a personal financial advisor available 24/7. Yet, like any tool, there are challenges and considerations that users need to be aware of. Let's understand potential pitfalls and how to effectively address them, turning challenges into opportunities.

Common Challenges and Solutions

1. Data Privacy Concerns

- Challenge: Handling sensitive financial data can raise privacy and security concerns. Unauthorized access could potentially lead to data breaches.

- Solution:

- Prioritize platforms with robust security protocols.

- Use encrypted connections and strong authentication processes.

- Regularly audit and update privacy settings to ensure compliance with data protection laws.

2. Data Accuracy and Integrity

- Challenge: AI agents rely on the quality of data they receive. Inaccurate or outdated information can lead to misleading insights and decisions.

- Solution:

- Regularly update financial information and verify data inputs.

- Periodically review the reports generated by the AI for consistency.

- Employ manual cross-checks to validate critical data points.

3. Personalization Limitations

- Challenge: AI agents might not yet fully cater to personalized financial nuances or adapt to individual risk tolerance levels.

- Solution:

- Customize settings and preferences to the extent possible.

- Use feedback loops: interact with the AI to guide and refine its recommendations.

- Stay involved in the decision-making process; AI should assist, not replace personal judgment.

4. Over-Reliance on Automation

- Challenge: Excessive dependence on AI for financial decision-making might lead to complacency and lack of financial acumen.

- Solution:

- Balance AI insights with personal financial knowledge and insights.

- Engage with learning resources to improve personal finance literacy.

- Set periodic check-ins to review AI-suggested actions.

5. Integration Issues

- Challenge: Integrating AI agents flawlessly with existing financial tools and platforms can sometimes be troublesome.

- Solution:

- Choose AI solutions known for seamless compatibility with existing systems.

- Engage with customer support or technical experts to troubleshoot integration hitches.

- Stay updated with the latest versions and updates which often improve compatibility.

6. Cost Considerations

- Challenge: The use of advanced AI agents could entail higher costs, which must be justified by their value addition.

- Solution:

- Clearly define the financial objectives the AI aims to achieve.

- Regularly assess the return on investment by measuring cost savings or efficiency gains.

Harness the power of AI agents in wealth tracking by acknowledging these challenges and implementing these solutions. Embrace the collaborative journey where AI enriches but does not replace, human financial expertise. Now, let's craft smarter wealth strategies together!