Transform your financial planning with AI Agents, designed to provide accurate and instantaneous calculations of potential savings interest. Let ClickUp Brain assist you in making informed decisions with unparalleled efficiency and precision.

How AI Agents Power Savings Interest Calculators

Imagine having a digital genius at your fingertips—ready to assist you in navigating the ins and outs of calculating savings interest with precision and ease. That's exactly what AI agents are here to do! For the Savings Interest Calculator, these intelligent virtual helpers streamline complex computations, ensuring you get accurate figures without breaking a sweat.

Different types of AI agents make this magic happen. Some focus on data analysis, crunching numbers efficiently behind the scenes. Others excel in customer interaction, answering questions, and providing guidance. Still, others might analyze market trends, ensuring you're aware of the best savings plans available. Each type serves a unique role, working together like a well-oiled machine to meet your savings goals effortlessly.

When it comes to the Savings Interest Calculator use case, AI agents handle tasks like calculating compound interest, projecting future account balances, and offering tailored savings strategies. Picture an AI agent inputting your current savings amount, desired interest rate, and timeframe—then, in the blink of an eye, you receive detailed projections of your potential earnings over time. Need to tweak your strategy? Another AI agent compares different savings plans to find the most lucrative options for you. It's like having a team of financial wizards, making sure your money works as hard as possible!

Benefits of Using AI Agents for Savings Interest Calculator

1. Time-Saving Efficiency

- AI agents quickly compute complex interest calculations, freeing up valuable time. Users can instantly view their potential savings growth without manual calculations or waiting around.

2. Enhanced Accuracy

- Minimize human errors with AI agents that consistently deliver precise computations. This enhances trust, allowing users to make informed financial decisions with confidence.

3. Personalized Financial Insights

- AI agents analyze individual financial data to provide tailored advice. Users receive personalized recommendations, helping them to optimize interest rates and maximize savings.

4. 24/7 Availability

- No need to wait for office hours or support teams. AI agents are available around the clock, providing on-demand assistance whenever users need it.

5. Improved User Experience

- With intuitive interfaces, AI agents simplify the process of calculating savings interest. This seamless experience keeps users engaged and encourages ongoing interaction with your platform.

Implementing AI agents for a Savings Interest Calculator not only boosts your service's practicality but also enhances user satisfaction, leading to increased business growth and customer loyalty.

AI Agents for Savings Interest Calculator

An AI agent designed for calculating savings interest transforms complex financial data into understandable insights. Whether you're setting up a savings plan or just curious about how your money can grow, this tool has you covered. Here are some practical ways it can assist you:

Personalized Savings Plans:

- Collects individual financial goals, initial deposit, and time horizon.

- Provides tailored savings projections and interest calculations.

Quick Interest Calculations:

- Computes interest amounts for various compounding frequencies.

- Gives instant feedback on how changes in rate or duration affect savings.

Comparison of Savings Accounts:

- Evaluates different savings accounts to identify which offers the highest returns.

- Compares interest rates, fees, and benefits of various options.

Proactive Rate Alerts:

- Monitors market trends and informs you when better interest rates become available.

- Helps you switch accounts to optimize your savings yield.

Financial Goal Tracking:

- Tracks progress toward your savings milestones.

- Suggests adjustments to stay on track with financial goals.

"What-If" Scenarios:

- Models various financial scenarios based on hypothetical changes (e.g., increasing monthly contributions).

- Helps you assess the impact of different strategies on your savings growth.

Automated Saving Suggestions:

- Analyzes spending patterns to recommend realistic saving amounts.

- Encourages habitual saving by setting reminders and motivating milestones.

Intuitive Visualizations:

- Provides clear graphs and charts to visualize growth over time.

- Offers detailed breakdowns of principal vs. interest earned.

Educational Insights:

- Explains complex financial terminologies in simple terms.

- Empowers you to make informed decisions about saving and investing.

Integrating an AI agent into your savings strategy simplifies the process and maximizes your financial growth. Ready to boost your savings game?

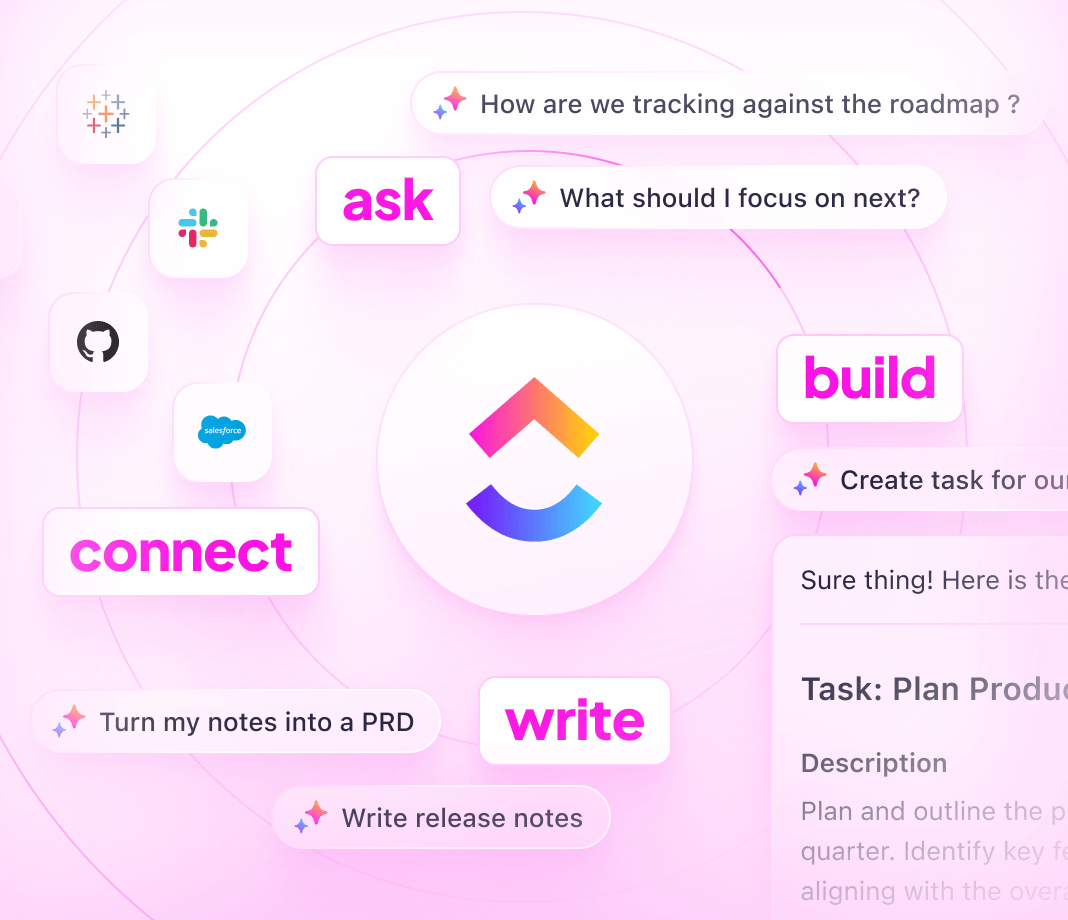

Enhance Your Workspace with ClickUp Brain Chat Agents

Welcome to the future of productivity! ClickUp Brain's Chat Agents are here to transform the way your team interacts within your Workspace. These AI superstars can autonomously answer and act based on your team’s questions and requests, ensuring seamless communication and task management.

What Can You Do with Chat Agents?

Chat Agents are all about making your life easier! They're the perfect digital teammates ready to adapt, interact, and achieve specific goals in your Workspace. Here's how they can be utilized:

Answer Questions Effortlessly: Deploy an Answers Agent for handling common questions about your product, services, or organization. This agent references specific knowledge sources and responds in real time, freeing you from repetitive queries.

Task Triage Like a Pro: Use a Triage Agent to seamlessly link tasks with relevant chat discussions. It automatically identifies conversations needing task connections, so no actionable item falls through the cracks.

Customize and Create Agents: Want even more? Create your own Chat Agent from scratch or tweak predefined agents, aligning them perfectly with your team’s unique needs.

These agents don’t just react—they take action! Whether it's answering questions or interfacing with Workspace items and people, their proactive nature ensures objectives are consistently met.

An AI Agent for Your Interest Calculations?

Imagine an AI agent designed specifically for calculating savings interest as part of your finance-focused workflows. While our Chat Agents have different focus areas, this concept highlights the potential and versatility of AI in your ClickUp Brain arsenal.

Configure an Agent to collate and process financial data, ensuring nothing is lost in translation—as if every task is woven together with the precision of a Savings Interest Calculator AI Agent.

Are you ready to streamline your workflow with the power of AI? Embrace ClickUp Chat Agents and transform your Workspace into a hub of efficiency and innovation! 🎉

Challenges and Considerations for Using AI Agents in Savings Interest Calculators

AI Agents are transforming how we handle calculations, making processes faster and more efficient. However, like any technology, they come with their own set of challenges. Let's chat about common pitfalls and how we can tackle them to make your experience as smooth as possible.

Common Challenges

Data Accuracy

- Pitfall: AI relies heavily on input data accuracy. Incorrect data can lead to misleading results.

- Solution: Always double-check your entries. Implement regular audits of input data to ensure consistency and accuracy.

Complexity in Algorithms

- Pitfall: AI algorithms can be complex, making it challenging for users to understand how calculations are performed.

- Solution: Simplify where possible. Provide explanations or tooltips that break down complex calculations into understandable language.

Handling Edge Cases

- Pitfall: Edge cases might not be adequately addressed, leading to errors or unexpected results.

- Solution: Test the AI Agent with a variety of scenarios, including worst-case scenarios, to ensure robustness. Continuous monitoring and updates are key to evolving accuracy.

Limitations

Lack of Contextual Understanding

- Limitation: While AI agents excel in number crunching, they may lack the nuanced understanding of specific financial contexts.

- Solution: Augment AI calculations with expert human interpretation where necessary. Providing guidance on when to seek professional advice can also be beneficial.

Dependency on Initial Conditions

- Limitation: Calculations are only as good as the initial assumptions and parameters.

- Solution: Encourage flexibility. Allow users to modify and simulate various parameters to see different outcomes, fostering a deeper understanding of scenarios.

Addressing Challenges

User-Friendly Interfaces

- Design intuitive interfaces that cater to both tech-savvy users and beginners.

Transparent Processes

- Make processes transparent and encourage users to engage with the AI by explaining how results are achieved.

Feedback Mechanisms

- Establish channels for users to provide feedback on inaccuracies or issues, creating a loop for continual improvement.

Continuous Learning and Updates

- Keep the AI Agent up-to-date with the latest algorithms and financial standards to maintain its relevancy and accuracy.

Security and Privacy

- Address possibly sensitive financial data by implementing robust security and privacy measures.

Remember, AI is a tool designed to assist, not replace human judgment. By being aware of these challenges and equipping yourself with strategies to address them, you’re on your way to making the most of AI in your savings interest calculations. Happy calculating!