Transform your financial world with AI Agents, quickly analyzing massive datasets to provide insightful metrics and accurate predictions. Say goodbye to manual number-crunching and hello to smarter, faster decisions—effortlessly managed with the aid of ClickUp Brain.

Fintech AI Agents: Revolutionizing Finance

AI Agents in fintech are like digital superheroes tailored for financial services. They efficiently tackle tasks that range from managing customer interactions to analyzing market trends, ensuring seamless operations without breaking a sweat. Equipped with the latest in AI technology, these agents work alongside finance professionals to enhance efficiency, accuracy, and decision-making.

Types of Fintech AI Agents:

- Customer Support Agents: Handle inquiries, resolve issues, and provide personalized service around the clock.

- Fraud Detection Agents: Monitor transactions to identify and prevent suspicious activities.

- Financial Advisors: Offer investment advice and portfolio management based on real-time data and analytics.

- Regulatory Compliance Agents: Ensure all financial activities comply with the latest regulations.

In the fintech landscape, AI Agents perform an array of tasks to streamline operations and amplify productivity. Picture a customer support agent tirelessly working through the night, greeting customers with tailored solutions to their unique problems. A fraud detection agent, on the other hand, is the vigilant guardian, meticulously scanning transactions and sending alerts before deceitful activities can scar a company’s reputation. Meanwhile, financial advisor agents crunch mountains of data to offer crisp, actionable insights for clients looking to make their money work smarter, not harder. From maintaining compliance with complex regulations to assisting clients at every turn, AI agents are the dynamic tools re-engineering the finance world.

The Benefits of Using AI Agents in Fintech

Harnessing the power of AI Agents in the fintech sector is a game-changer. Not only do they streamline operations, but they also drive significant business impact. Here's why they're a must-have:

Enhanced Customer Experience

- AI Agents provide personalized, 24/7 customer support, eliminating wait times.

- They can handle common inquiries, leaving human agents to tackle complex issues, ensuring a smoother service.

Fraud Detection and Prevention

- AI Agents analyze transaction patterns in real-time, identifying suspicious activities promptly.

- They continually learn from data patterns, improving accuracy in predicting and preventing fraudulent activities.

Cost Efficiency

- Automation reduces operational costs by minimizing the need for large customer support teams.

- Self-service options through AI Agents decrease dependency on physical infrastructure, saving on space and maintenance costs.

Data-Driven Insights

- AI Agents collect and process vast amounts of data, delivering actionable insights for strategic planning.

- They can forecast market trends and customer behaviors, helping businesses make informed decisions.

Streamlined Compliance and Reporting

- Automatically monitor regulatory changes and ensure adherence to compliance standards, reducing manual effort.

- Generate reports quickly and accurately, ensuring financial transparency and accountability.

Adopting AI Agents in fintech not only enhances efficiency and accuracy but also positions your business at the forefront of innovation.

Transform Your Fintech Operations with AI Agents

Say goodbye to mundane tasks and hello to streamlined operations. AI Agents can revolutionize your fintech operations by efficiently managing, automating, and optimizing a myriad of tasks. Here’s how you can put AI Agents to work:

Risk Assessment and Management

AI Agents analyze vast datasets in real-time to identify potential risks and flag anomalies. They provide predictive insights to make data-driven decisions, enhancing security and compliance.Fraud Detection

Monitor transactions through AI-driven pattern recognition. AI Agents are incredibly efficient at detecting fraudulent activities by identifying unusual patterns and providing alerts to prevent potential losses.Customer Support

AI Agents handle routine inquiries and support tasks like account information updates via chat or email, ensuring your customers receive 24/7 assistance and enhancing user satisfaction.Investment Advisory

Offer bespoke investment advice by leveraging AI Agents to analyze financial markets, historical data, and client profiles, thus tailoring investment strategies to optimize returns.Loan Processing

Streamline loan applications with AI Agents that automate data extraction from applications, evaluate creditworthiness, and expedite approval processes by analyzing applicant eligibility.Portfolio Management

Automate the tracking and rebalancing of investment portfolios. AI Agents enable real-time monitoring and offer insights by assessing market conditions to keep portfolios aligned with client goals.Regulatory Compliance

Facilitate compliance by monitoring regulations and ensuring adherence. AI Agents can quickly adapt to changes in regulatory requirements, minimizing the risk of non-compliance penalties.Expense Management

Simplify expense tracking and reporting through AI Agents that categorize transactions, generate expense reports, and provide insights into spending trends, enhancing budget management.Financial Forecasting

Use AI Agents to predict market trends and company financial performance by analyzing current data, allowing for strategic planning and more informed decision-making.Personalized Marketing

Enhance marketing strategies with AI Agents that analyze customer data to deliver tailored content, promotions, and recommendations, boosting user engagement and conversion rates.

Unleash the potential of AI Agents in fintech and watch your efficiency soar!

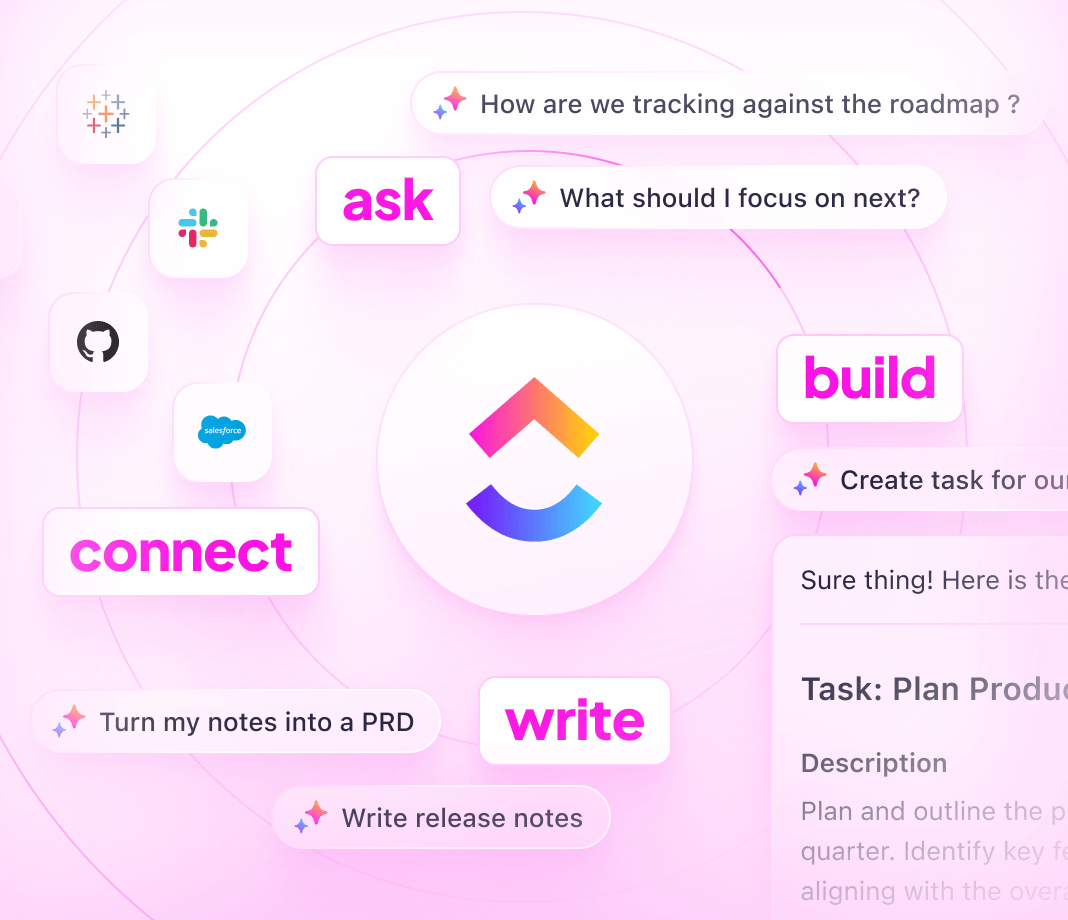

Enhance Your ClickUp Workspace with ClickUp Brain Chat Agents

Imagine being able to streamline your productivity by having AI at your service, answering questions, and ensuring tasks aren't slipping through the cracks. With ClickUp Brain Chat Agents, this isn't just a dream — it's your new reality!

Why Use Chat Agents?

ClickUp Chat Agents adapt and respond to changes in real time within your Workspace. They're not just reactive but proactive, autonomously answering inquiries and taking the initiative to perform actions based on your team’s needs. Here's how they can make a difference:

Answer Questions Efficiently: Set up the Answers Agent to tackle team queries about products, services, or company specifics. Define the knowledge sources the Chat Agent should pull information from, allowing for accurate and swift response times.

Stay on Top of Tasks: Triage Agent ensures no task is left behind. It scopes out relevant Chat threads to connect with pertinent tasks, keeping everyone in the loop and on point with action items.

Chat Agents in Action: Fintech AI Scenario

Consider a fintech scenario where keeping abreast of new updates and ensuring no task is missed is crucial. By employing an Answers Agent, team members can quickly resolve their product or service questions, improving efficiency and reducing disruptions. Simultaneously, a Triage Agent will comb through fintech-related discussions, linking them to action items, so nothing important slips away.

Key Features

- Autonomous Decision Making: Once activated, Chat Agents make decisions based on the tools, instructions, and data they have access to.

- Real-Time Responsiveness: They adjust and respond as your Workspace evolves.

- Customizable and Goal-Oriented: Modify their predefined prompts to suit unique needs and focus them on achieving specific goals.

Get Started

Creating or customizing a ClickUp Chat Agent is a breeze. Make them work for you, tailoring their actions to fit your precise requirements. Need a bespoke Agent? You can also create a Chat Agent from scratch!

With ClickUp Brain Chat Agents, your team can improve response times and keep tasks synced within your Workspace. Experience smoother operations and enhanced productivity — all with a touch of AI magic! 🚀

Navigating Challenges with Fintech AI Agents

Fintech AI agents are revolutionizing the financial industry, offering streamlined processes and smarter insights. But like any technology, they have their hurdles. Here's how to expertly navigate the potential challenges and keep your fintech operations sailing smoothly.

Common Pitfalls & Limitations

Data Privacy Concerns

- The Challenge: Handling sensitive financial data can lead to privacy issues if not managed properly.

- Solution: Implement robust data encryption and ensure compliance with top-tier security standards. Regular audits and monitoring will help maintain airtight security.

Bias in Decision Making

- The Challenge: AI systems can inadvertently carry biases from training data, leading to skewed financial assessments.

- Solution: Use diverse and representative datasets in training. Continuous monitoring and reviewing decisions against known biases can further mitigate this risk.

Integration Complexities

- The Challenge: Seamlessly integrating AI agents into existing systems can be daunting.

- Solution: Start small with pilot projects to identify potential integration hurdles. Collaborate with IT teams for a phased integration approach that minimizes disruptions.

Lack of Transparency

- The Challenge: AI decisions are sometimes referred to as "black boxes," difficult to interpret or explain.

- Solution: Opt for AI models that offer explainability features, allowing insights into decision-making processes. This builds trust and understanding among users.

Regulatory Compliance

- The Challenge: Navigating the complex regulatory environment can be overwhelming.

- Solution: Keep abreast of regulatory changes and ensure your systems are compliant. Regular training sessions can help your team stay informed and prepared.

Dependence on Vendors

- The Challenge: Over-reliance on AI vendors can lead to challenges in service continuity and flexibility.

- Solution: Negotiate clear terms with vendors regarding support, updates, and exit strategies. Consider developing in-house expertise to reduce dependency.

Proactive Strategies

- Continuous Learning: Stay updated with the latest AI advancements and industry trends to anticipate future challenges.

- User Training: Regularly train your team to effectively leverage AI tools, maximizing their potential while understanding limitations.

- Feedback Loops: Establish channels for users to provide feedback. This helps in identifying issues early and iteratively improving the AI system.

Embracing fintech AI agents requires a strategic approach and a preparedness to tackle the accompanying challenges. With thoughtful consideration and proactive measures, you can harness the full potential of AI to transform your financial services.