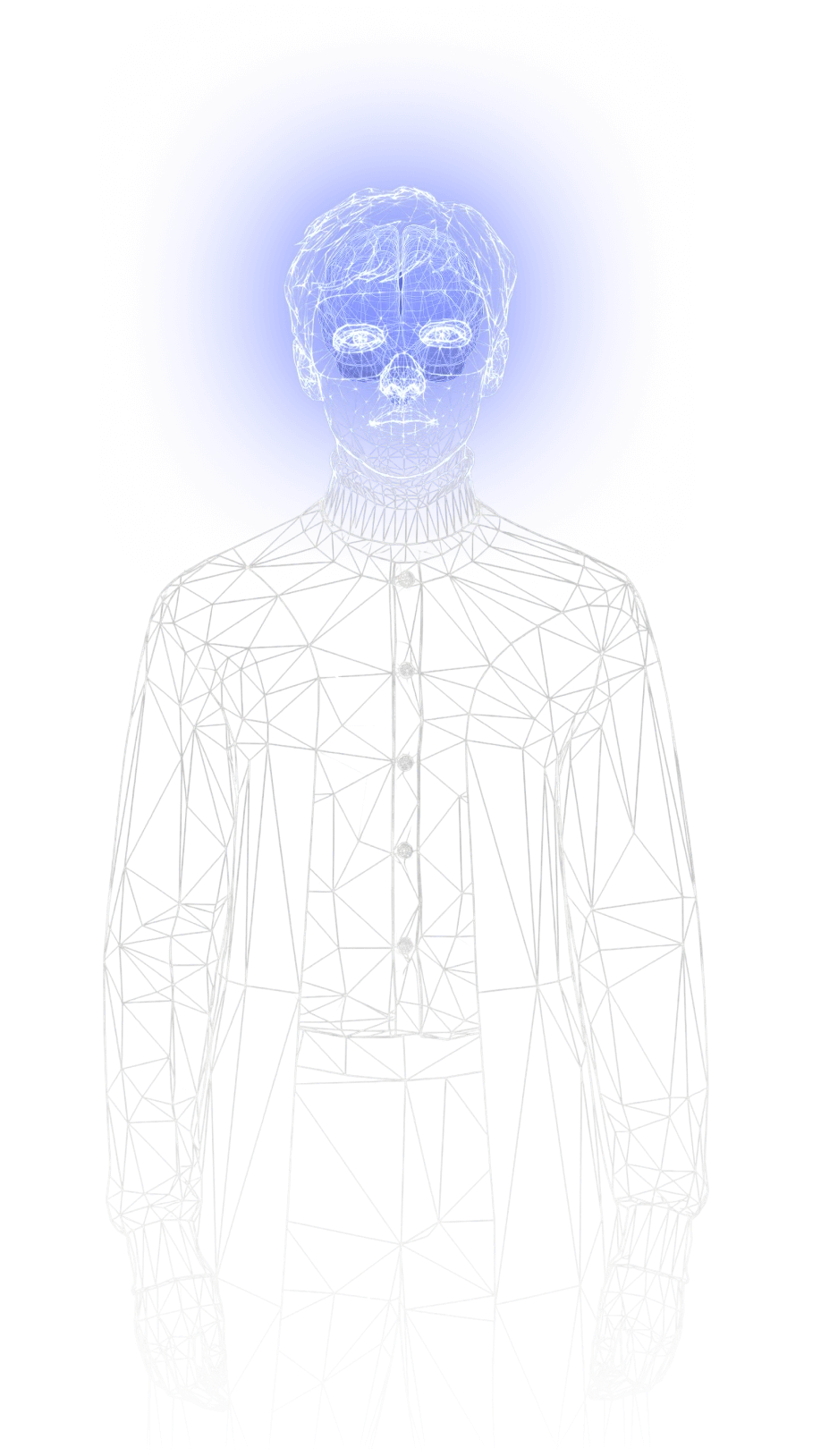

A new era of humans,

with AI Super Agents.

Super

Agents

They’re just like humans

Maximize human productivity with agentic teammates - @mention, assign tasks, & message directly. Choose when, how, and what they work on - always improving with infinite knowledge & memory.

Human Powers

SuperPowers

SuperIntelligence

Infinite Memory. Recent memory, working memory, and long-term memory are automatically stored and recalled.

Super

Agents

A new era of humans,

with AI Super Agents.

SAVE 2 DAYS EVERY WEEK, GUARANTEED.

Delegate everything

Tag them in just like any human teammate and watch them adapt to your workflows, integrate with your tools, and execute with superhuman capabilities.

CAPABILITIES

Agents for everything

The world’s only infinite agent catalog where anyone can create and customize agents for any type of work imaginable.

PM Agents

Sales Agents

Coding Agents

async function deployAgent() {

const agent = new SuperAgent();

agent.configure({

model: "Development",

memory: true,

tools: ["web", "code", "data"]

});

await agent.train(dataset);

await agent.optimize();

return agent.deploy({

env: "production",

scale: "auto"

});

}

const result = await deployAgent();

console.log(result.status);Designer Agents

Custom Agent

Super Agents created in ClickUp

Agents in minutes

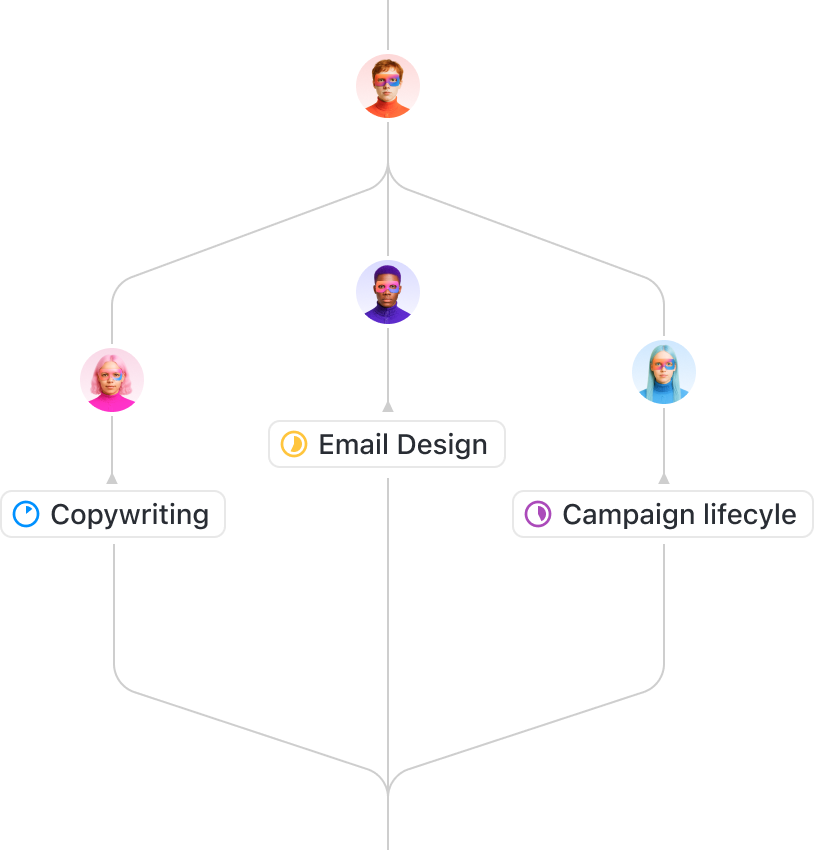

One prompt spins up an entire team

Your goals, workflows, and frustrations - automatically delegated to a team of agents.

Do more than humanly

possible

"The holy grail of what enterprises are chasing

- this is a game changer for work productivity."

— Jay Hack, CEO of Codegen

The only agents that work like humans - with infinite skills

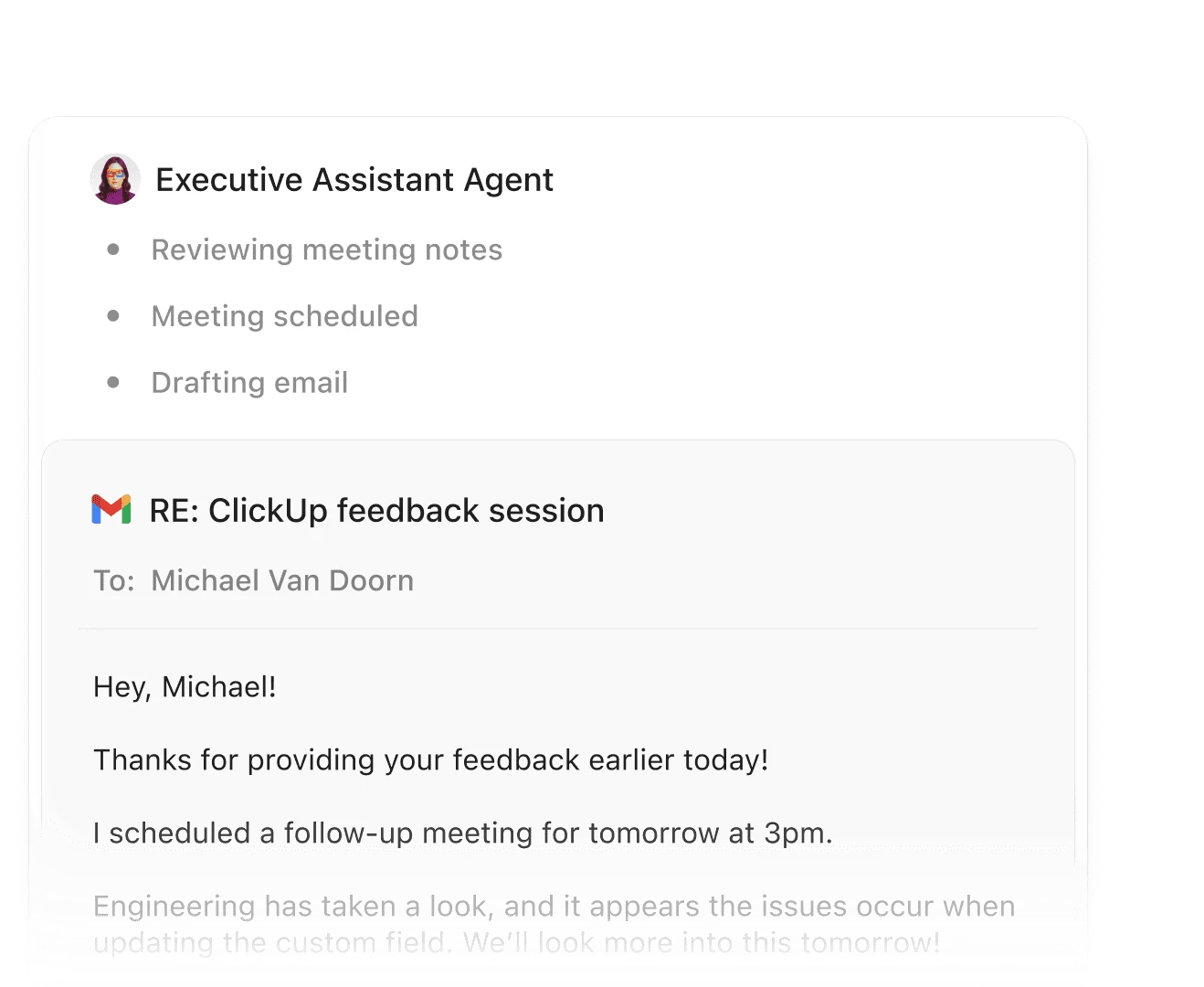

Send Email

Super Agents manage, draft, and send clear, accurate emails based on context in ClickUp.

Collaborate alongside humans

Just like a highly skilled teammate

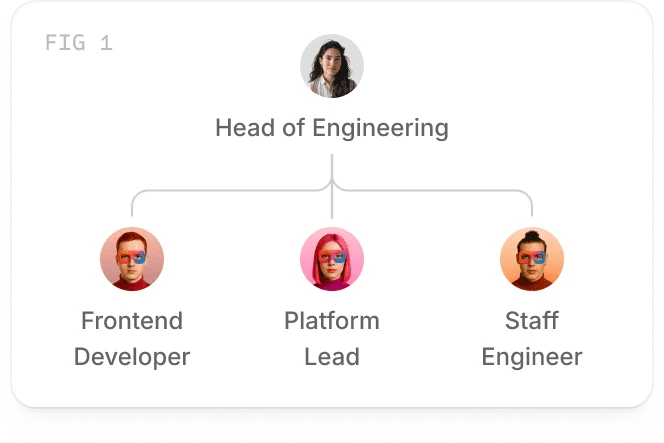

Managed by humans

Agents have managers

Become superhuman,

with Super Agents.

Superhero

intelligence

AI without context and engagement is useless.

— Every AI Expert

Capabilities

01

Memory

AI agents are sophisticated software entities designed to operate autonomously within digital environments.

Agents have episodic memory, agent preferences memory, short-term memory and long-term memory.

Proprietary Agentic Technology

Our custom platform uses contextual engagement, orchestration, and fine-tuning to provide maximum human productivity.

Agent Analytics

Measure productivity across teams, monitor trends, and spot your top performers.

0%

ADOPTION.

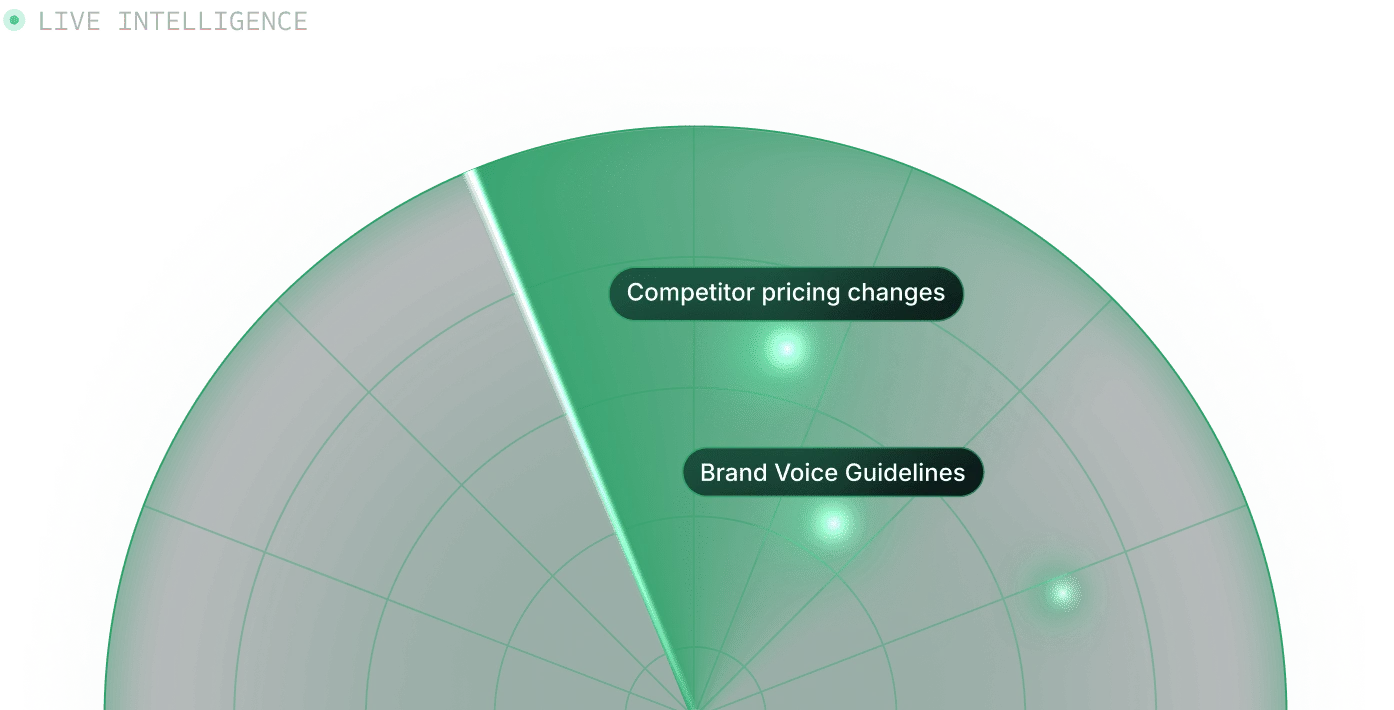

Ambient Awareness

Automatically jumps in when helpful without being triggered manually - giving you automatic AI value without relying on humans to adopt it.

0

QUESTIONS ANSWERED

22 AGENTS ONLINE

Next milestone

25,000

Milestone complete

20,000

Milestone complete

10,000

Context Intelligence

Actively monitors all context to capture & update knowledgebases for people, teams, projects, decisions, updates, and more.

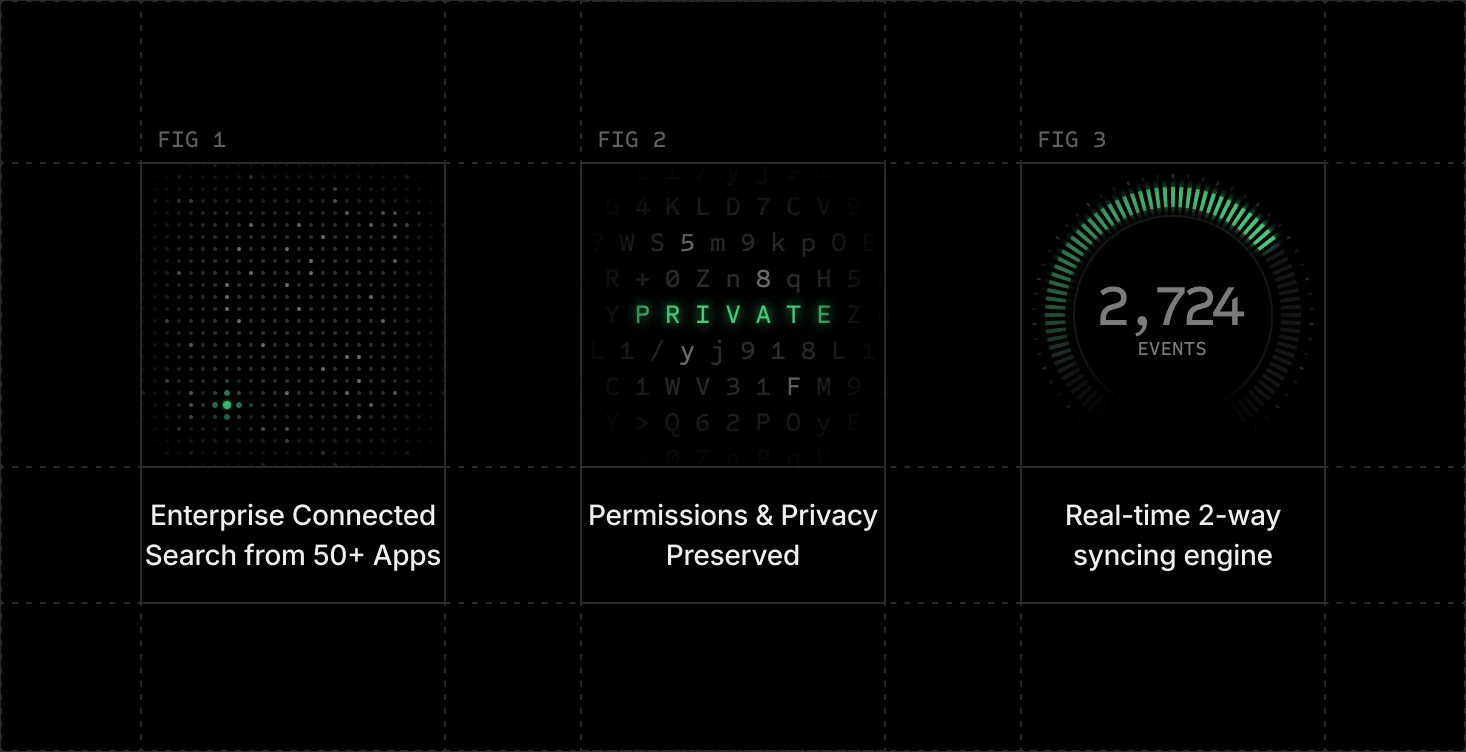

Infinite Knowledge

Proprietary real-time syncing engine with world-class retrieval from fine-tuned embeddings. Enterprise search from infinite connected knowledge.

Brain MAX

Proprietary models, architecture, and evals.

Optimized Orchestration

Route to the best models from intent.

Self-Learning

Continuous learning and improvement.

Human-level Memory

Short, Long-Term, & Episodic Memory.

Sub-Agent Architecture

Multi-agent collaboration and delegation.

Deep Research & Compression

Research optimally from compressed context.

Agentic User Security

Completely proprietary AI user data model compatible with all enterprise security systems, and familiar to all humans.

Implicit & Explicit Access, with Custom Permissions

Built on the same battle-tested user data model your team already uses. Super Agents can inherit implicit access, have explicit permissions, and be given access manually.

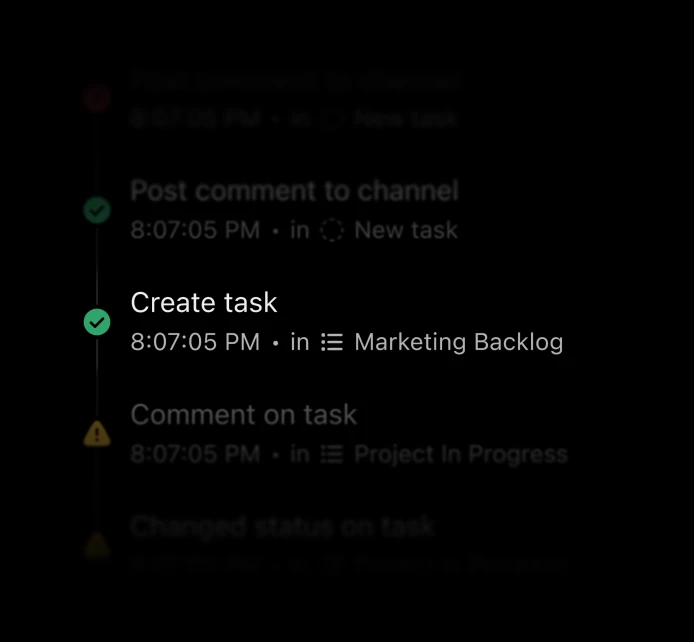

Audit everything

Extraordinarily deep insight and auditing into everything Agents do.

Zero data retention.

Zero training.

More secure than using OpenAI, Gemini directly.

Reflection

Advanced execution loops that ensure Agents constantly reflect on work they're doing.

When we optimize, you save $

When our teams save on AI costs, we pass them onto you. When sudden increases in AI costs occur, we subsidize the cost. If AI providers raise rates, we'll adjust pricing gradually and transparently, while continuing to optimize wherever possible.

Try Super Agents today