Revolutionize your financial tracking with Bookkeeping AI Agents; they streamline repetitive data entry, ensure accuracy in accounting, and provide real-time financial insights. And with ClickUp Brain, turbocharge your productivity by harnessing tailored intelligent support for seamless bookkeeping management.

How AI Agents Revolutionize Bookkeeping

AI Agents are digital superheroes designed to streamline and automate the bookkeeping process. In the world of accounting, these specialized agents tackle repetitive tasks with precision, saving you time and reducing human error. Think of them as your personal financial sidekick, always ready with the right tool for your accounting needs!

Types of Bookkeeping AI Agents

- Data Entry Agents: Automate invoice processing and ledger updates.

- Expense Tracking Agents: Monitor real-time expenses and categorize them automatically.

- Report Generation Agents: Create and send financial statements or cash flow reports.

- Compliance Agents: Ensure all financial data aligns with current regulations.

Competitors in this field might include automated accounting software packages and various plug-and-play digital assistants tailored for specific bookkeeping tasks. No need to wrestle with spreadsheets or stacks of receipts anymore!

AI Agents in Action

Imagine an AI agent deftly managing your business’s financial data. It takes over tasks like sorting through endless piles of receipts, tracking expenses, and updating ledgers—all with a few simple commands. You simply scan or forward a receipt, and these clever agents will categorize and log it into the proper accounts in a flash. Tasks that once took hours are now reduced to mere minutes.

For example, an Expense Tracking Agent might recognize a lunch meeting expense from an emailed receipt, classify it correctly, and update your records instantly. Meanwhile, a Report Generation Agent pulls together a detailed financial report, providing insights into your business's financial health. With these digital wizards in place, you can focus on strategic decisions, knowing your bookkeeping is handled with automated accuracy.

Benefits of Using AI Agents for Bookkeeping

AI Agents are revolutionizing the world of bookkeeping by offering a dynamic range of benefits that cater to both everyday tasks and long-term business goals. Let's roll up our sleeves and examine how these agents can be game-changers for your finance operations.

1. Streamlined Data Entry

- Accuracy: AI Agents minimize human error by handling repetitive data entry tasks with precision.

- Speed: They process information swiftly, freeing up time and reducing processing hours.

2. Real-Time Financial Insights

- Immediate Updates: Access up-to-the-minute financial data without waiting for end-of-period reports.

- Data-Driven Decisions: Make informed business decisions backed by real-time analytics.

3. Enhanced Security

- Robust Data Protection: Implement sophisticated algorithms to safeguard sensitive financial information.

- Fraud Detection: AI continuously monitors transactions and flags unusual patterns.

4. Cost Efficiency

- Reduce Overhead: AI Agents require no additional salaries or benefits, leading to significant cost savings.

- Optimized Resource Allocation: Redirect human resources to more strategic roles that require creativity and critical thinking.

5. Compliance and Reporting

- Automatic Compliance: Stay up-to-date with the latest regulations as AI adjusts processes to adhere to legal standards.

- Effortless Reporting: Generate comprehensive reports with just a few clicks, ensuring you meet all reporting requirements quickly.

With these benefits, AI Agents are more than just tools; they're key allies in transforming bookkeeping into a seamless and strategic function. Who knew crunching numbers could be so exciting?

AI Agents for Bookkeeping: Practical Applications

AI Agents can revolutionize the bookkeeping process, making it more efficient and error-free. Here's a list of specific ways an AI agent can enhance bookkeeping tasks:

Automated Data Entry

- Eliminate manual entry errors by automatically uploading and categorizing financial transactions.

- Seamlessly integrate with bank accounts to fetch transaction data in real-time.

Invoice Management

- Generate, send, and track invoices to ensure timely payments.

- Monitor due dates and send payment reminders automatically.

Expense Tracking

- Maintain a real-time log of all expenses, categorized for easy reporting and analysis.

- Utilize receipt scanning for quick entry into the expense register.

Bank Reconciliation

- Match transactions from bank statements with those recorded in your books.

- Identify and alert discrepancies for quick resolution.

Tax Preparation Assistance

- Organize and classify transactions under appropriate tax categories.

- Keep track of tax deadlines and prepare relevant reports.

Financial Reporting

- Generate detailed financial reports such as profit and loss statements, balance sheets, and cash flow statements.

- Provide insights and trends based on historical data.

Budget Management

- Set budget limits and track spending against these limits in real-time.

- Alert when spending approaches or exceeds the set budgets.

Predictive Analysis

- Analyze past financial data to forecast future cash flow and revenues.

- Provide actionable insights to optimize financial planning.

Compliance Monitoring

- Ensure adherence to financial laws and regulations by monitoring transactions.

- Alert on actions required for legal compliance.

By leveraging AI agents, bookkeeping can become a more seamless, accurate, and insightful process, helping businesses stay focused on growth while taking care of the numbers.

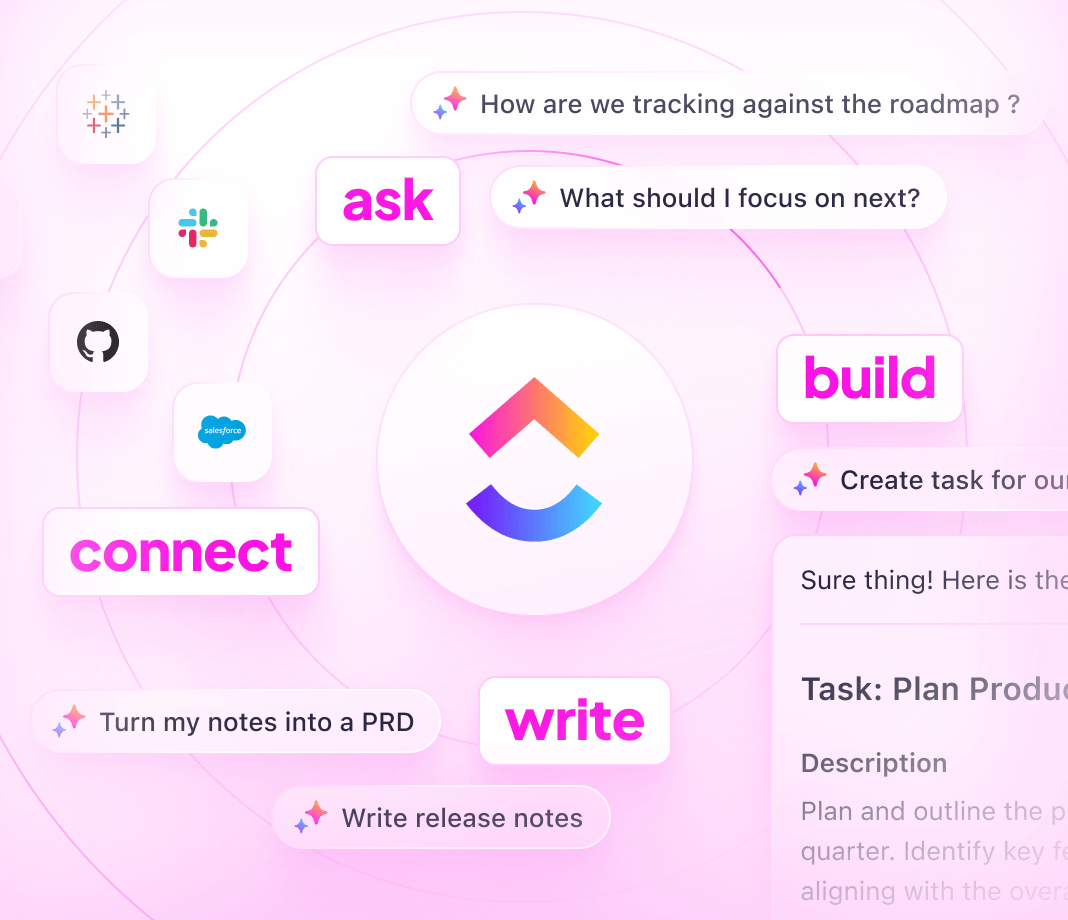

Unleash the Power of ClickUp Brain Chat Agents in Your Workspace

Imagine having a team member who never sleeps, tirelessly handling questions and ensuring no tasks fall through the cracks. That's not a dream—it's your ClickUp Brain Chat Agent in action! Integrating these digital dynamos into your Workspace opens doors to a smoother, more efficient workflow.

How Chat Agents Spark Joy in Your Workspace

ClickUp Brain Chat Agents are the buddies you didn’t know you needed. Activated once they're in your Workspace, they autonomously adapt, answer, and act, making your team's life a breeze.

Chat Agents and Their Marvelous Tricks:

Answers Agent: Have questions about products or services popping up in Chats? Let the Answers Agent take the wheel! It promptly responds to inquiries by tapping into specified knowledge sources. Think of it as your friendly information guru, ensuring no team member is left hanging.

Triage Agent: Never lose sight of tasks in the middle of dynamic conversations. The Triage Agent scans Chat threads, linking talks to relevant tasks. It's like having a diligent overseer connecting the dots in your bustling chat ecosystem.

Customize and Conquer

Ditch the one-size-fits-all approach; Chat Agents come with customizable prompts tailored to meet your team’s unique needs. Craft a seamless workflow by pre-defining criteria and knowledge sources for your Agents, ensuring every question and task is handled with precision.

Imagine a World with Our Bookkeeping Buddy

Picture a bookkeeping AI agent within ClickUp using these features—swiftly answering team questions about invoices or expense reports while methodically transforming task discussions into actionable items. All neatly woven into the Chat Agents’ realm, they ensure bookkeeping conversations translate into a well-organized task list, ready for action.

The ClickUp Chat Agent Experience Awaits

While in beta and subject to change, Chat Agents signify a powerful leap in smart workspace management—only accessing public items for now, but question by question, task by task, they make your workspace a more engaging, responsive environment. Embrace the autonomy and efficiency they bring. Your bookkeeping team—and your entire team—is in for a treat!

Challenges and Considerations for AI Agents in Bookkeeping

AI Agents can revolutionize bookkeeping, but they're not without their challenges. Addressing these head-on will ensure smooth sailing for your financial tasks. Let’s walk through potential pitfalls, limitations, and strategic solutions to keep your bookkeeping operations optimized.

Common Pitfalls

Data Inaccuracy

- Challenge: AI Agents rely heavily on data accuracy. Incorrect data inputs can lead to flawed financial reporting.

- Solution: Regular audits of the data inputs and thorough validation processes can enhance data accuracy.

Lack of Contextual Understanding

- Challenge: AI might struggle with understanding the nuanced context of certain transactions or financial anomalies.

- Solution: Supplement your AI system with human oversight, using AI to handle routine tasks while humans focus on complex issues.

Security Concerns

- Challenge: Handling sensitive financial data demands robust security protocols.

- Solution: Implement strong encryption, regular security audits, and adopt best practices for data protection.

Limitations

Adaptation to Complex Scenarios

- Limitation: AI Agents might face difficulties with highly complex, unconventional bookkeeping scenarios.

- Solution: Customize and regularly update your AI system to improve its ability to handle complex tasks over time.

Dependence on High-Quality Input Data

- Limitation: The output quality is directly tied to the input quality, posing a risk if data is incomplete or corrupted.

- Solution: Establish rigorous data entry standards and continuous data cleansing to ensure consistent quality.

Initial Setup and Integration

- Limitation: Setting up AI systems can be time-consuming and requires thorough integration with existing systems.

- Solution: Plan for comprehensive training and a step-by-step integration process to mitigate initial setup challenges.

Addressing Challenges Constructively

Training and Continuous Learning

- Encourage continuous workforce training to work harmoniously with AI. Training programs help your team understand how to leverage AI effectively.

Feedback Loops

- Establish feedback mechanisms where both AI outputs and human insights contribute to refining the system’s processes.

Ongoing Support and Maintenance

- Regular updates and system maintenance are crucial. Partner with tech experts to keep your AI agents in top shape.

Remember, AI Agents are here to assist, not replace. When used thoughtfully, they can become powerful allies in taming the wild world of bookkeeping!